Crypto Markets Analysis: Bitcoin Muddles Along; Consumer Credit Debt Could Present Problems

In the final week of 2022, bitcoin’s tepid price movement veered from a recent, year-end pattern of wide swings stemming largely from investors’ anticipation of heightened volatility.

Bitcoin moved just 1.6% last year compared to 7% and 20% shifts in 2021 and 2020, respectively.

The weak price action capped a disappointing 2022 for BTC – a year that was hard on risk assets as the tech-focused Nasdaq and S&P 500, which has a strong technology component, plummeted 33% and 19%, respectively.

For the first time in its history, bitcoin’s price declined in four consecutive quarters.

ETH barely avoided this distinction after rising in the third quarter largely on the strength of the Ethereum Merge, which shifted the protocol from proof-of-work to more energy efficient proof-of-stake.

The limited price movement indicates that demand for the asset class is weak. Lack of volatility is often unappealing to short-term traders. Looming macroeconomic hurdles have also soured retail investors.

For now, BTC seems most attractive to patient, long-term bullish investors, looking to accumulate at a perceived discount.

Looking ahead, the same crypto ballad of woe still has a few notes left, despite investor hopefulness that the bear market will peter out.

Liquidity continues to ring loudly. The U.S. central bank remains committed to reducing inflation via interest rate increases and balance sheet reductions.

“M2” money supply for the U.S. decreased in 2022, as the Federal Reserve worked to slow inflation. Money supply in the Eurozone declined in each of the last two months, although the money supply in China and Japan actually rose.

The push and pull between inflation control and economic stimulus in the world’s two largest economies by gross domestic product (GDP) remains unsettling for global asset markets.

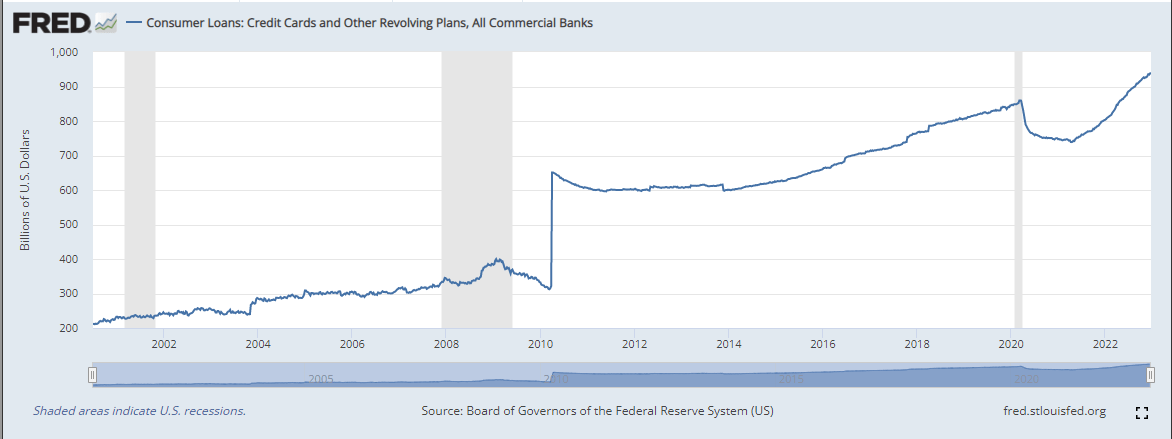

A disconnect also exists between the extension of credit to corporations and the growth of revolving credit among individual consumers.

Though not a completely apples to apples comparison, the difference implies that reduced access to credit is reining in corporate expansion. Still, consumers appear to have loaded up on potentially troublesome debt. There was an understandable decline in revolving debt in 2020, in response to the global Covid-19 pandemic. Since then however, consumer revolving debt levels have increased to all- time highs. The following dynamic appears to be present:

- Economic stimulus added to the money supply and resultant inflation

- Consumers increased their personal debt levels

- The fight against inflation has led to increased interest rates, economic slowing and possible higher unemployment.

But consumer debt most assuredly has to be repaid, even as high inflation lingers and growth brakes..

Given the large role that retail investors play in crypto investment, repayment obligations could reduce discretionary investing capital, adding another hurdle to crypto markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Gate

Gate  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Basic Attention

Basic Attention  Qtum

Qtum  Zilliqa

Zilliqa  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond