EOS Technical Analysis: Will The EOS Rebound From Its One-Year-Low?

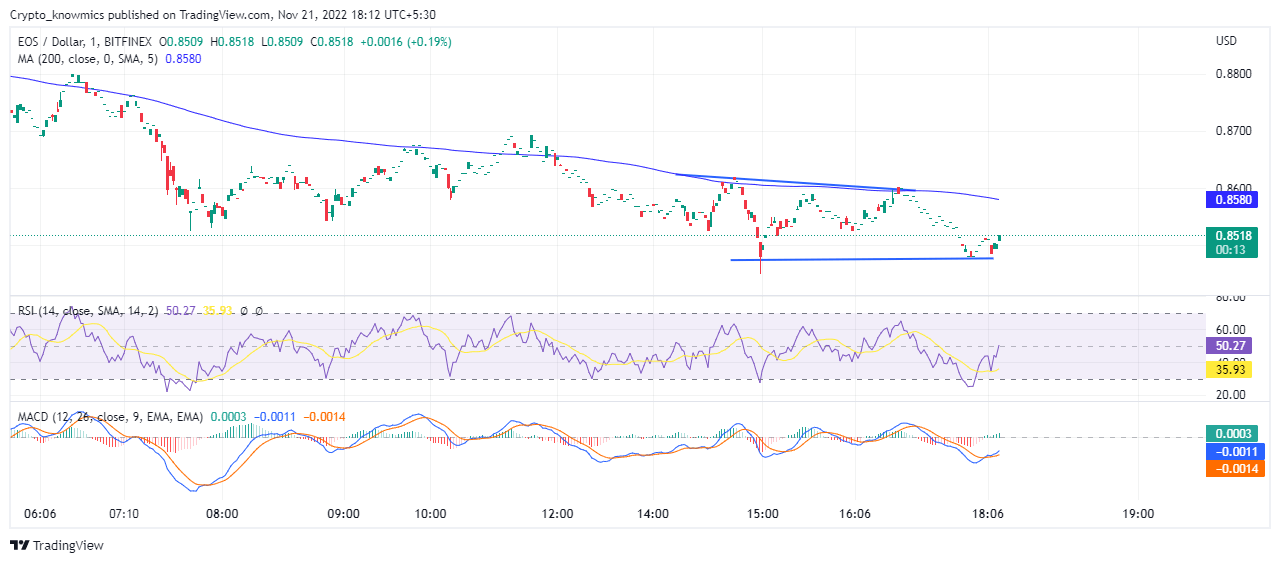

The EOS technical analysis displays consolidation despite a declining trend, after prices pulled back from $0.84, eyeing another breakout as RSI signal enthusiasm among buyers. EOS has been going through a strong downtrend over the last two weeks due to the financial crises of crypto exchange FTX, as the token has plunged more than 23.2% in the last 14 days, hitting its 52-week low of 0.$82 on November 10. Although the prices attempted to rebound EOS could not break above $0.91 and pull back to $0.85 which accounted for a drop of 4.35% over the last 24 hours. EOS’s decline is supported by the market cap which also dropped by 4.07% during the last 24 hours due to a lack of demand among traders. While 24 hours trading volume of EOS jumped 53.17% the token showed signs of reversal as RSI displayed a balance between demand and supply.

Key Points

- The EOS price actions show consolidation despite bearish momentum

- Pull back at $0.84 signal towards potential bullish reversal

- With a 53% jump, the intraday trading volume in EOS stands at $142.96 million

Source: Tradingview

EOS Technical Analysis

After witnessing a sharp drop over the last few days, today’s trading chart represents that EOS prices have been consolidating between the range of $0.86 and $0.84. Although EOS price actions maintain a downtrend, the 200-day SMA teasing the resistance trendline signals the possibility of a bullish breakout in the near future. At a current price of $0.85, the EOS prices pulled back from $0.84 twice, indicating the increasing chances of a bullish reversal. If prices witness a bullish breakout at this stage, the EOS may break above the psychologically important mark of $1, providing multiple buying opportunities for the sideline traders. Conversely, if the token falls below $0.80 it may trigger another selling spree that would take the price below the $0.50 mark.

Technical Indicators

RSI narrowly escaped the bearish divergence after making a bullish divergence above the oversold boundary, approaching the midway line, with a 14-day moving average at the 35 mark showing slight relief from selling pressure. On the other hand, after making a bullish crossover, fast and slow lines showed increasing gaps as MACD is set for another upswing on a bullish histogram. The technical indicators show that EOS tries to gain reversal momentum after consolidating with the RSI striking a balance between demand and supply with another upswing on the MACD chart.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  NEM

NEM  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur