Here’s How Solana Price Can Get Another 30% Leg Up

The Solana (SOL) price broke out from a short-term resistance line but is still trading inside a long-term resistance area.

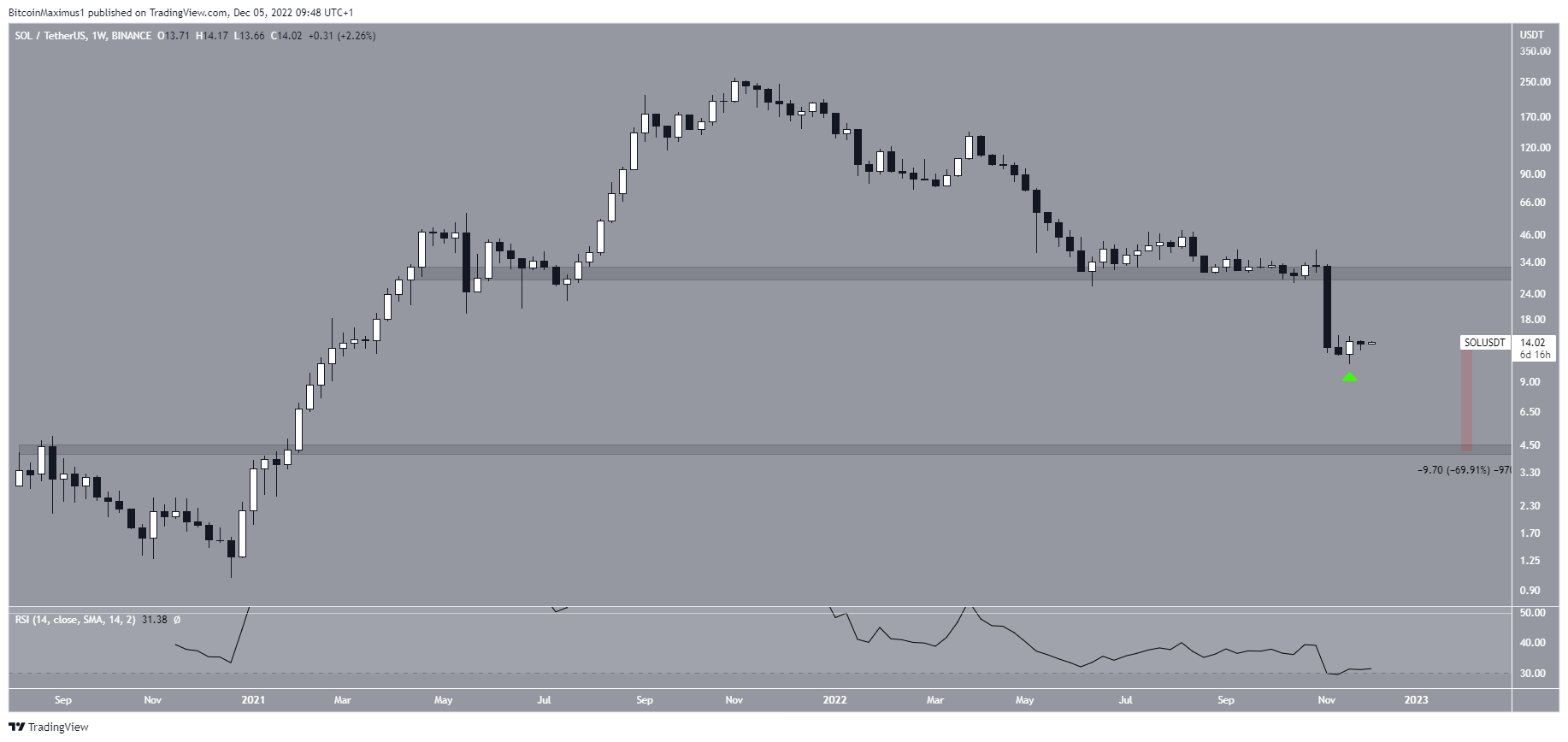

SOL is the native token of the Solana blockchain, created by Anatoly Yakovenko. The price history from the weekly chart shows that the Solana price has fallen since reaching an all-time high of $259.90 in Nov. 2021.

The downward movement led to a low of $10.94 in Nov. 2022. The decrease also caused a breakdown from the long-term support area with an average price of $29.

The weekly RSI is decisively bearish. It is decreasing, is below 50 and has yet to generate any bullish divergence.

The next closest support area is at $4, which would be a fall of 70% from the current price. Conversely, the $29 area is now expected to provide resistance.

Therefore, the weekly time frame is leaning on a bearish Solana (SOL) price prediction.

SOL/USDT Weekly Chart. Source: TradingView

Solana Price Begins Relief Rally

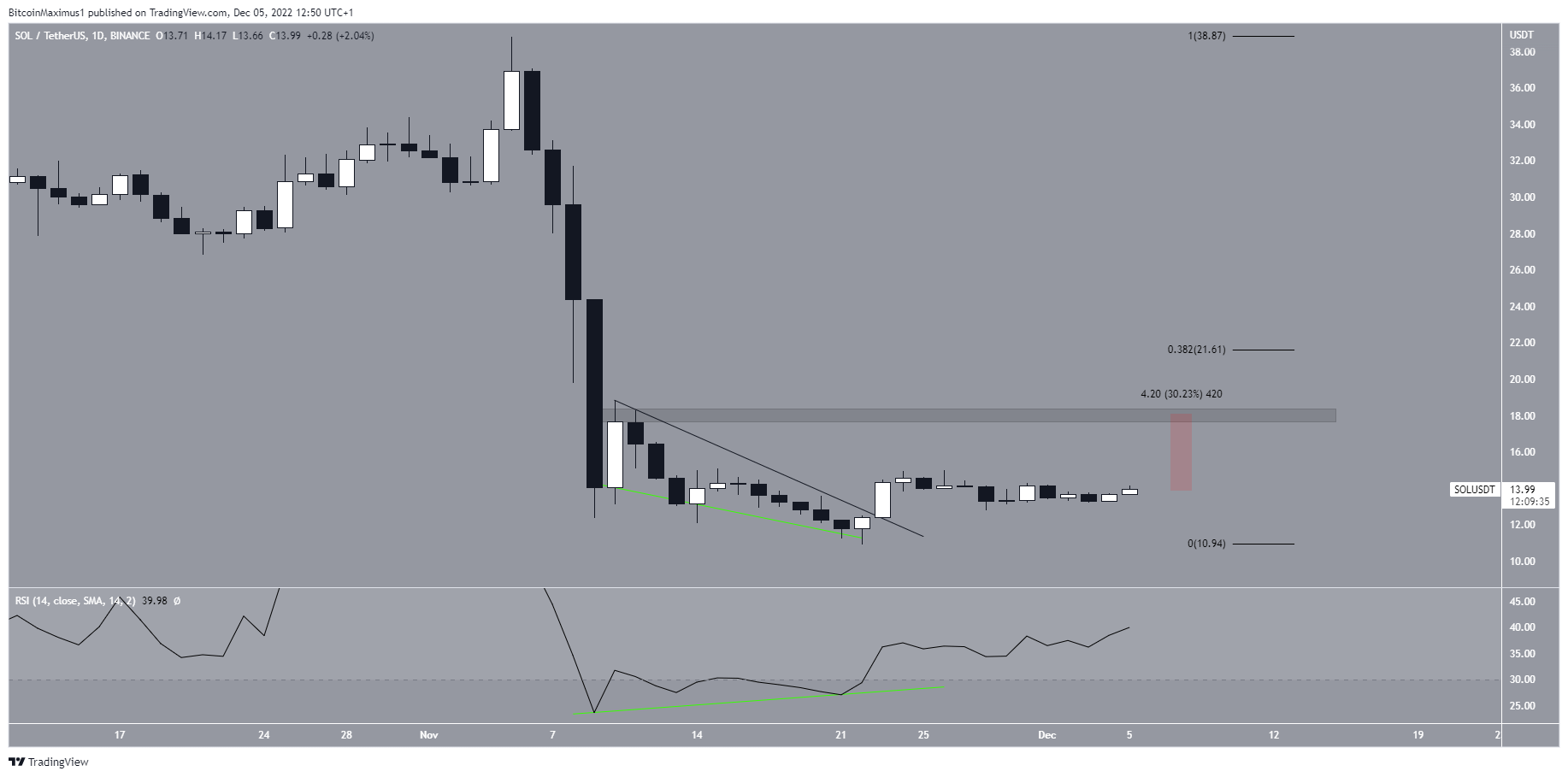

The price chart from the daily time frame is more bullish than that from the weekly one. Solana broke out from a descending resistance line on Nov. 23 and has increased since. While the upward movement initially stalled, the price increased significantly over the past 24 hours.

The upward movement was preceded by bullish divergence in the daily RSI. The indicator increased considerably after the divergence and is now approaching the 50 line. Moving above it would bode well for the future price.

The closest resistance area is at $18, 30% above the current price.

The most likely Solana price prediction suggests that the Solana price will reach it. However, due to the bearish readings from the weekly time frame, the long-term trend remains bearish.

Even if the SOL price were to break out from the $18 area, the trend can only be considered bullish once the long-term $29 area is reclaimed.

SOL/USDT Daily Chart. Source: TradingView

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD