Price analysis 1/27: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, AVAX

After two weeks of a stupendous rally, Bitcoin’s (BTC) price has largely been flat this week. This is a positive sign as it shows that market participants are not growing nervous before a slew of central bank meetings take place next week. The United States Federal Reserve, European Central Bank and Bank of England are scheduled to announce their policy decisions next week.

The confidence of the bulls received another boost after the U.S. core personal consumption expenditures (PCE) data for December showed the slowest annual rate of increase since October 2021. The core PCE rose 4.4% from a year ago, meeting analyst expectations.

Daily cryptocurrency market performance. Source: Coin360

According to a report by Markus Thielen, the head of research and strategy at Matrixport, U.S. institutions have not abandoned the cryptocurrency markets. The financial services firm arrived at this conclusion by assuming that if the gains happened during U.S. trading hours, it is because institutions are buying. Using this metric, the firm said that 85% of the rally in January was due to institutional buying.

Could Bitcoin and select altcoins shrug off their range-bound action and resume the uptrend? Let’s study the charts of the top-10 cryptocurrencies to find out.

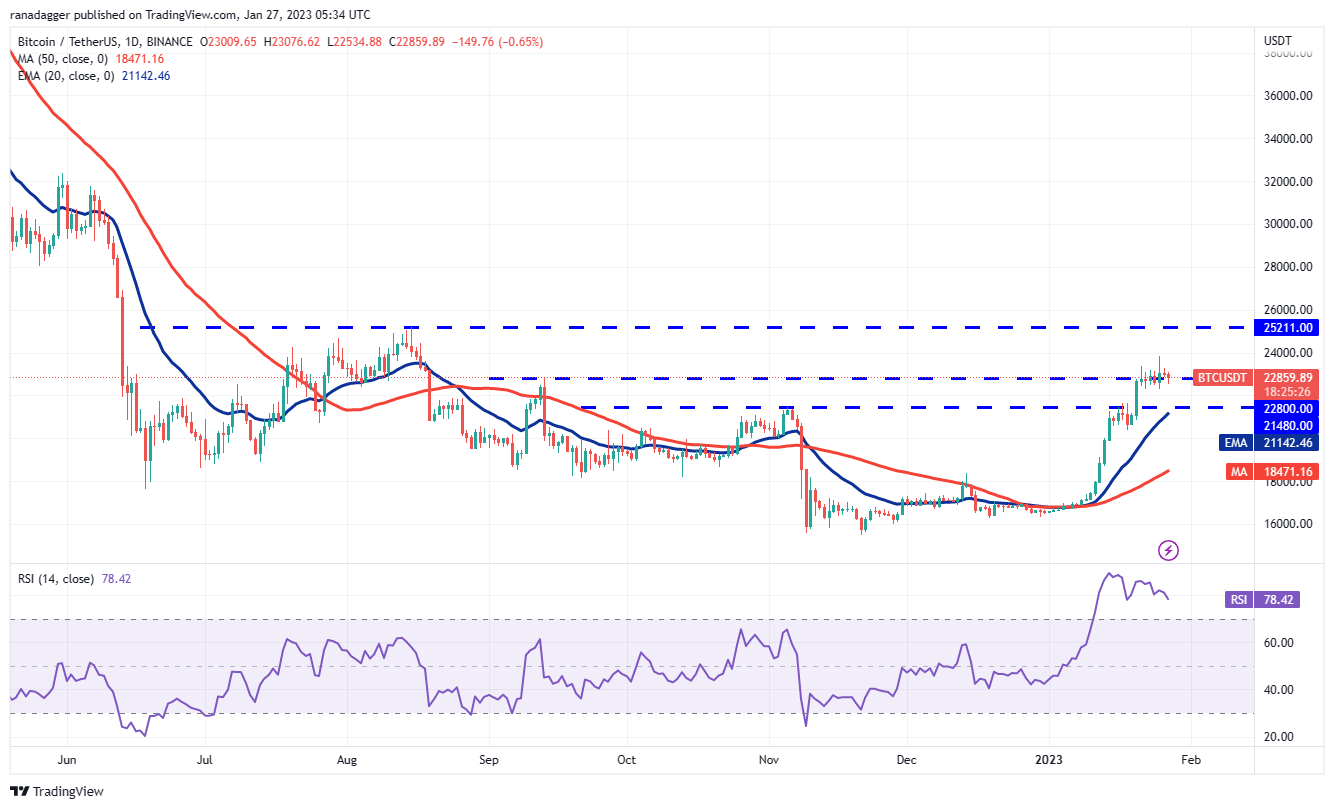

BTC/USDT

Bitcoin soared to $23,816 on Jan. 25 but the bulls could not sustain the higher levels as seen from the long wick on the day’s candlestick.

BTC/USDT daily chart. Source: TradingView

The repeated failure of the BTC/USDT pair to maintain above $23,000 may tempt short-term traders to book profits. The immediate support is at $22,292. If this level gives way, the pullback could reach the 20-day exponential moving average ($21,172).

This is an important level to keep an eye on because a sharp rebound off it will suggest strong demand at lower levels. The pair could then again try to resume its up-move and reach the critical overhead resistance at $25,211.

On the other hand, if the price turns down and plummets below the 20-day EMA, it will signal that bulls may be rushing to the exit. The bears may gain back control below $20,400.

ETH/USDT

Buyers could not build upon Ether’s (ETH) solid rebound off the 20-day EMA ($1,520) on Jan. 25, which suggests that bears are selling on recoveries near the overhead resistance of $1,680.

ETH/USDT daily chart. Source: TradingView

The bears will have to pull the price below the horizontal support near $1,500 to tilt the short-term advantage in their favor. The ETH/USDT pair could then start its decline toward the strong support at $1,352.

If bulls want to avoid this near-term bearish view, they will have to quickly drive the price above the overhead resistance at $1,680. If they manage to do that, the pair could start its journey to $2,000, with a brief stop-over at $1,800.

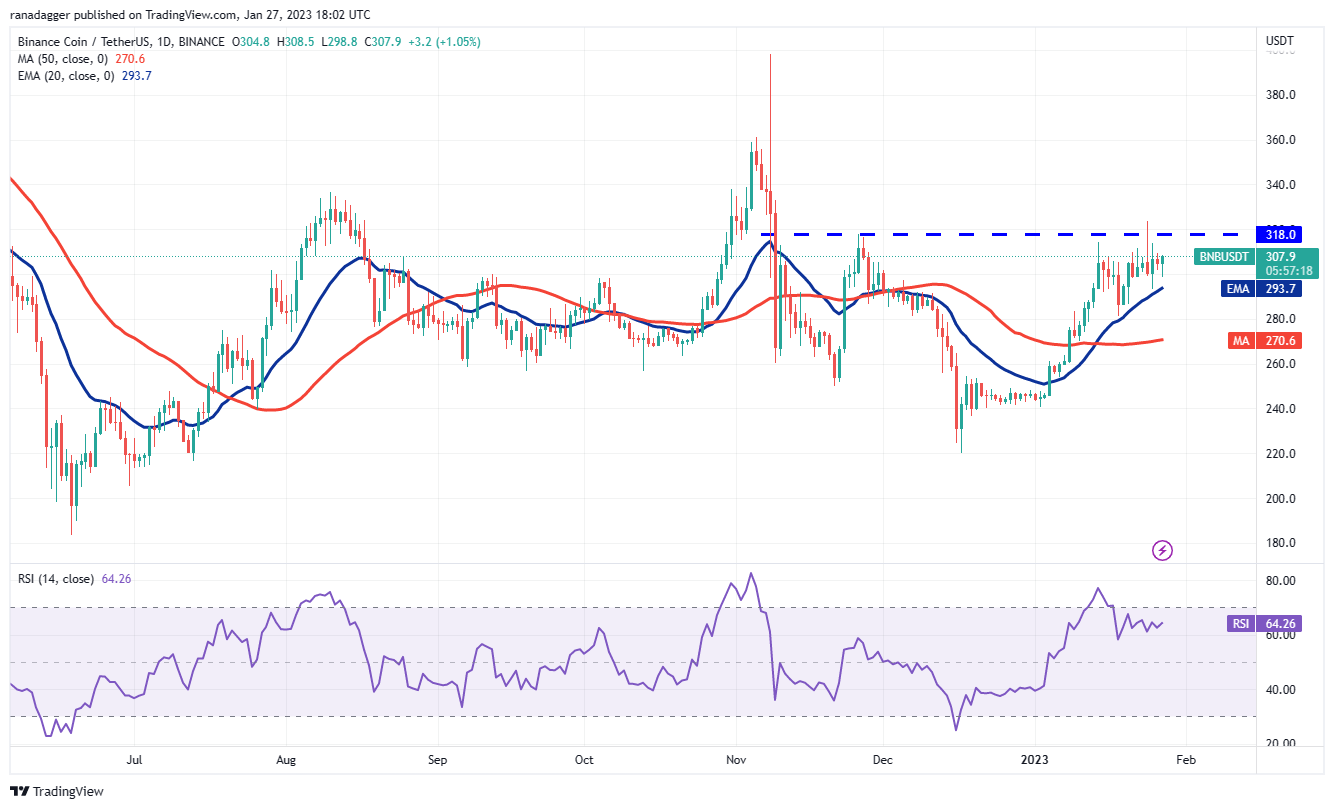

BNB/USDT

BNB (BNB) has been sandwiched between the 20-day EMA ($293) and the overhead resistance of $318 for the past few days. This shows that bulls are buying the dips to the 20-day EMA and bears are selling on rallies near $318.

BNB/USDT daily chart. Source: TradingView

The upsloping 20-day EMA and the relative strength index (RSI) in the positive territory indicate buyers have a slight edge. To build upon this advantage, the bulls will have to propel and sustain the price above $318. If they succeed, the BNB/USDT pair could pick up momentum and surge to $360.

The bears are likely to have other plans. They will try to fiercely protect the $318 level and tug the price below the 20-day EMA. If they do that, the pair could drop to $281. This level may act as a minor support but if cracks, the pair could touch the 50-day simple moving average ($270).

XRP/USDT

XRP (XRP) jumped from the 20-day EMA ($0.39) on Jan. 25 and rose above the $0.42 overhead resistance but the buyers could not sustain the price above it.

XRP/USDT daily chart. Source: TradingView

The repeated failure to clear the overhead hurdle may tempt the short-term bulls to book profits. That could drag the price below the 20-day EMA and open the doors for a possible drop to the 50-day SMA ($0.37).

This negative view could invalidate in the near term if the price turns up from the 20-day EMA and ascends the $0.42 to $0.44 zone. The XRP/USDT pair could then start a strong rally that could touch $0.51.

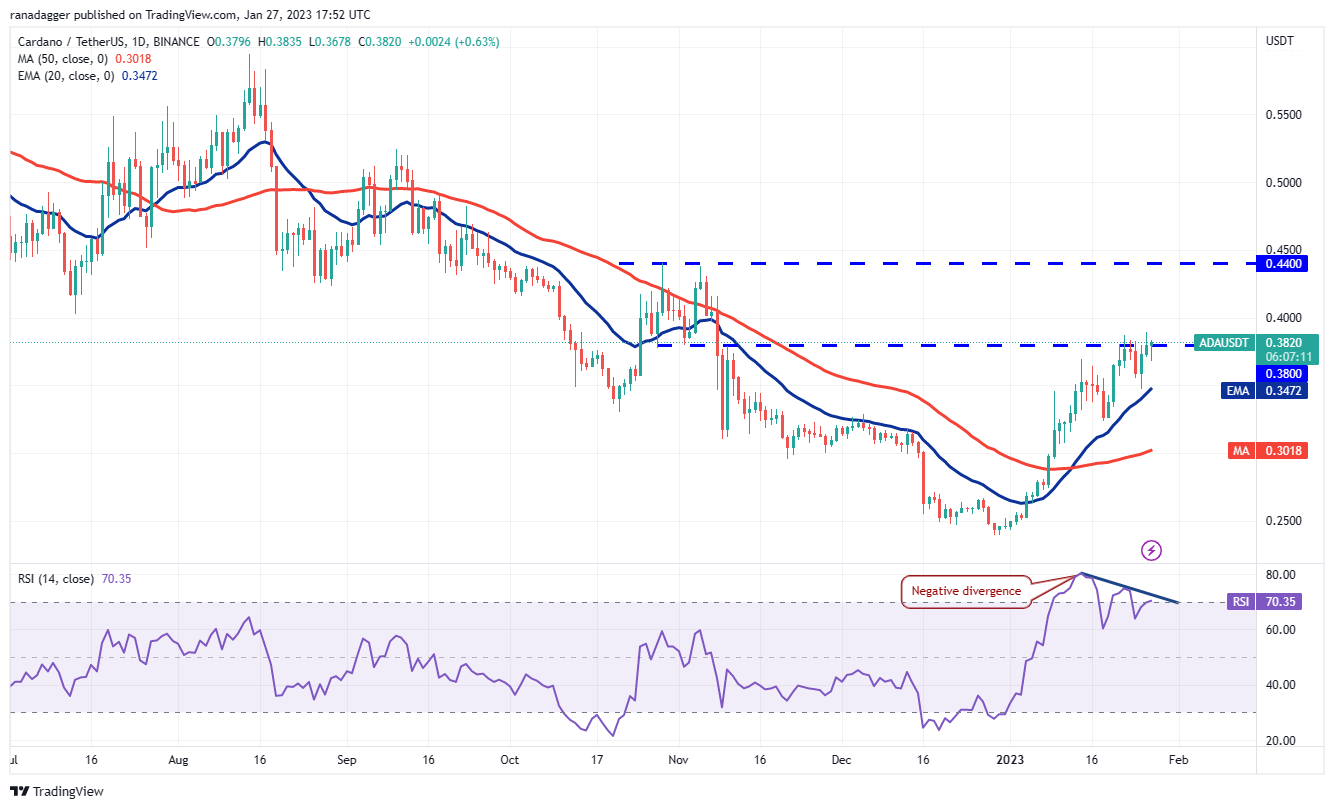

ADA/USDT

Cardano (ADA) rose above the $0.38 overhead resistance on Jan. 26 but the bulls could not sustain the higher levels. Still, it is pertinent to note that if a resistance gets pierced frequently, it tends to weaken.

ADA/USDT daily chart. Source: TradingView

The bulls will once again try to thrust the price above the overhead resistance. If they can pull it off, the ADA/USDT pair could spurt to $0.44. This level may again act as a formidable barrier but if the bulls do not give up much ground, the pair could continue its uptrend.

The upsloping 20-day EMA indicates advantage to buyers but the negative divergence on the RSI cautions that the bullish momentum may be weakening. The bears will have to sink the price below the 20-day EMA to start a deeper correction to the 50-day SMA ($0.30).

DOGE/USDT

Dogecoin (DOGE) bounced off the 20-day EMA ($0.08) on Jan. 25 but the bulls could not continue the recovery on Jan. 26. The price turned down and slipped to the 20-day EMA on Jan. 27.

DOGE/USDT daily chart. Source: TradingView

The DOGE/USDT pair is stuck between $0.09 and the 20-day EMA for the past few days. If the price turns up from the current level and rises above $0.09, the likelihood of a rally to the next resistance at $0.11 increases.

Alternatively, if the price continues lower and plunges below the 20-day EMA, it will suggest that the bulls are losing their grip. The pair could then dive to the strong support at $0.07. Such a move could point to a possible range-bound action between $0.07 and $0.09 for a few more days.

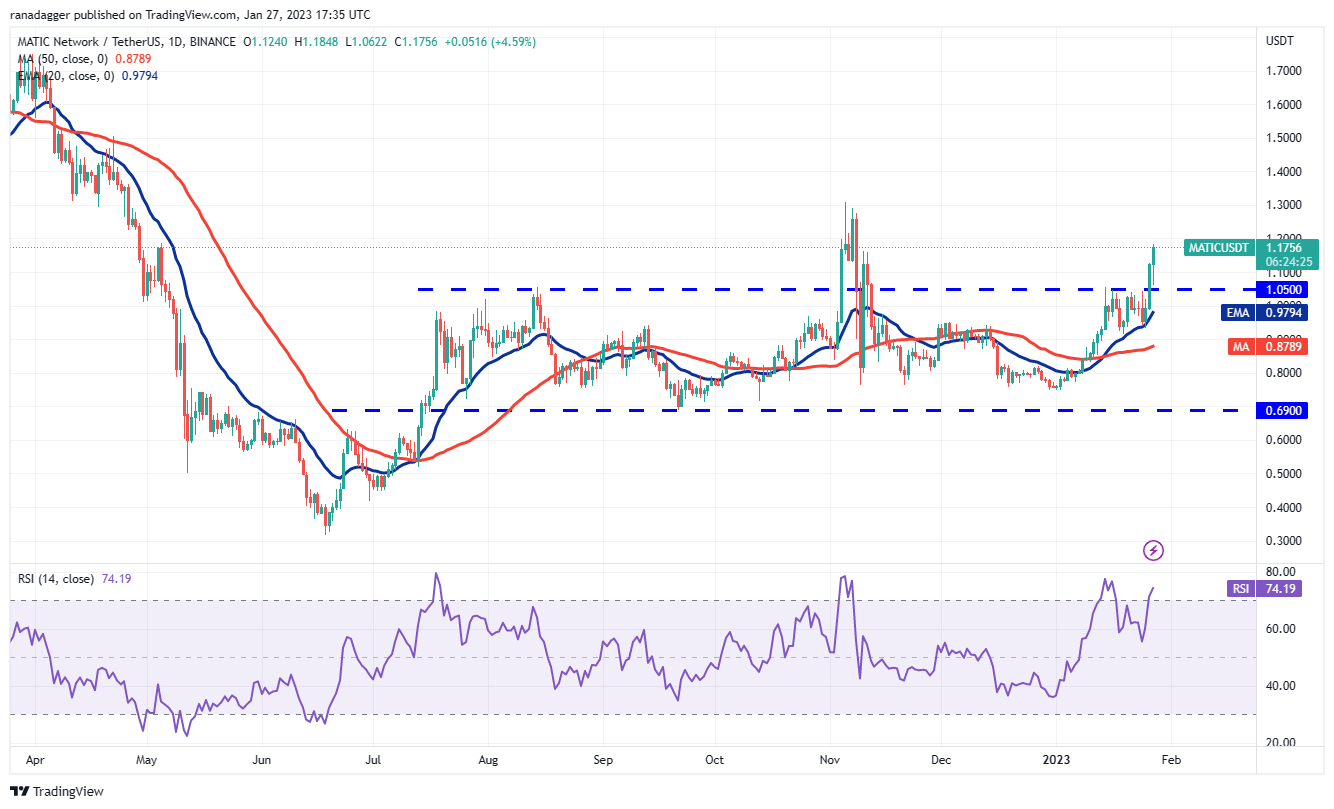

MATIC/USDT

Polygon (MATIC) rebounded off the 20-day EMA ($0.97) on Jan. 25 and skyrocketed above the crucial resistance of $1.05 on Jan. 26. The break above this level indicates that the uncertainty of the range resolved in favor of the bulls.

MATIC/USDT daily chart. Source: TradingView

The buyers continued to build upon the momentum and the MATIC/USDT pair crossed the minor resistance at $1.16 on Jan. 27. This clears the path for a possible rally to $1.30 where the bears may again mount a strong defense. If bulls surmount this obstacle, the rally could extend to $1.50.

Contrarily, if the price turns down sharply and breaks below $1.05, it will suggest that the breakout may have been a bull trap. The pair could then slide to $0.91.

Related: Litecoin ‘head fake’ rally? LTC price technicals hint at 65% crash

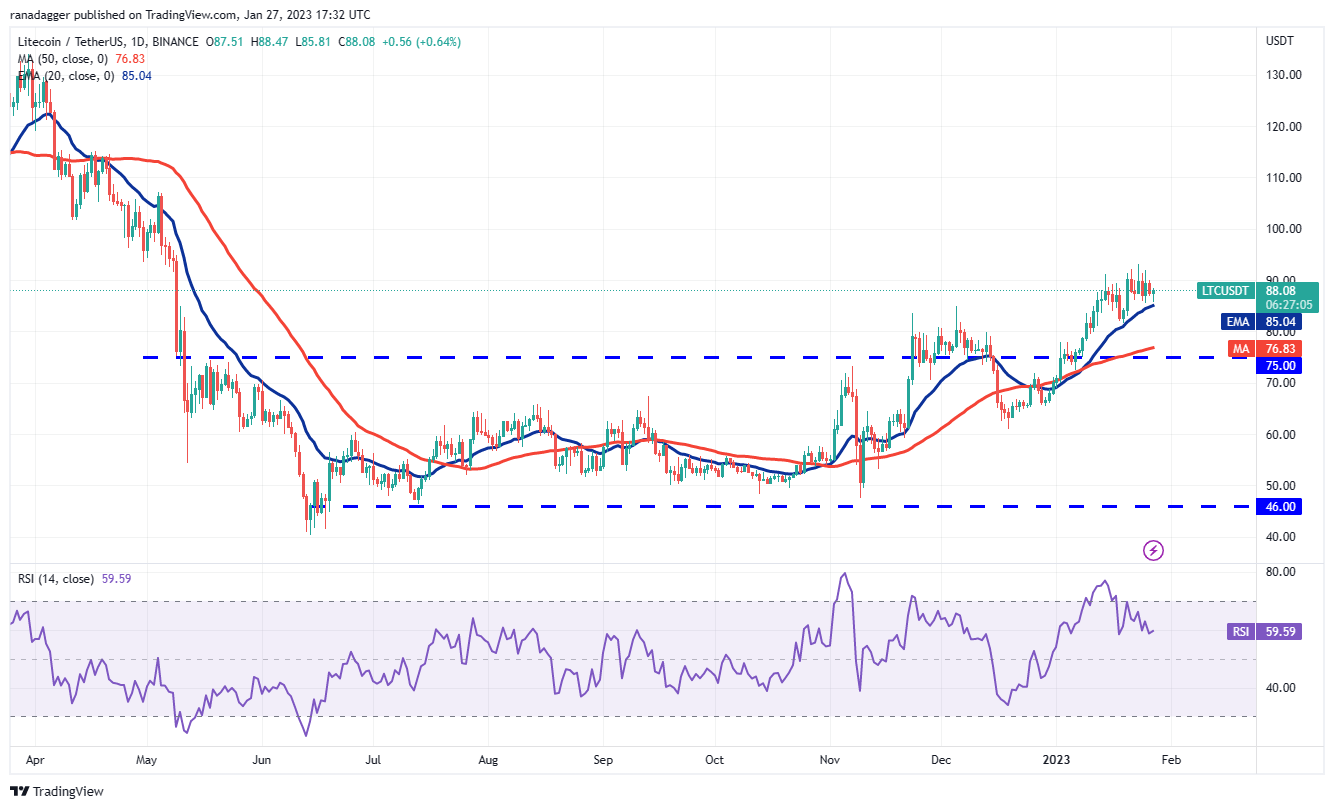

LTC/USDT

Litecoin (LTC) has been oscillating between the 20-day EMA ($85) and the overhead resistance at $92 for the past few days. This suggests uncertainty among the bulls and the bears about the next directional move.

LTC/USDT daily chart. Source: TradingView

Although the upsloping moving averages indicate advantage to the bulls, the negative divergence on the RSI suggests that the buying pressure seems to be decreasing. The bears will gain the upper hand if they succeed in pulling the price below the 20-day EMA.

That could trigger the stops of short-term traders and the LTC/USDT pair could then tumble to $81 and later to $75.

If bulls want to assert their dominance, they will have to kick and sustain the price above $92. That could signal the resumption of the uptrend. The pair could then travel to $100 and subsequently to $107.

DOT/USDT

Polkadot (DOT) has been trading near the resistance line for the past few days. Usually, a tight consolidation near a strong overhead resistance shows that buyers are holding on to their positions as they anticipate a move higher.

DOT/USDT daily chart. Source: TradingView

If buyers catapult the price above the resistance line, the DOT/USDT pair could signal a potential trend change. The pair could then start its journey toward $8.05, with a short stop-over at $7.42.

Conversely, if the price fails to maintain above the resistance line, it will suggest that demand dries up at higher levels. That could attract profit-booking by the short-term traders. The pair could first drop to the 20-day EMA ($5.88) and if this level collapses, the decline could reach $5.50.

AVAX/USDT

The bulls tried to propel Avalanche (AVAX) above the resistance line on Jan. 26 but the bears thwarted their attempt. The bulls did not cede ground to the bears and are again trying to overcome the barrier on Jan. 27.

AVAX/USDT daily chart. Source: TradingView

The upsloping moving averages and the RSI near the overbought territory indicate the path of least resistance is to the upside. If the price breaks above the resistance line, the AVAX/USDT pair could rally to $22 and thereafter to $24.

On the downside, a break and close below the 20-day EMA ($16.31) will be the first indication that the buying pressure is reducing. That could open the doors for a possible drop to $14.65 and thereafter to the 50-day SMA ($13.69).

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD