Stablecoin usage remain high despite crypto winter

Reflexity Research cofounder Will Clemente tweeted on Dec. 5 that stablecoins were one of the few crypto use cases that have found product market fit despite the current market condition.

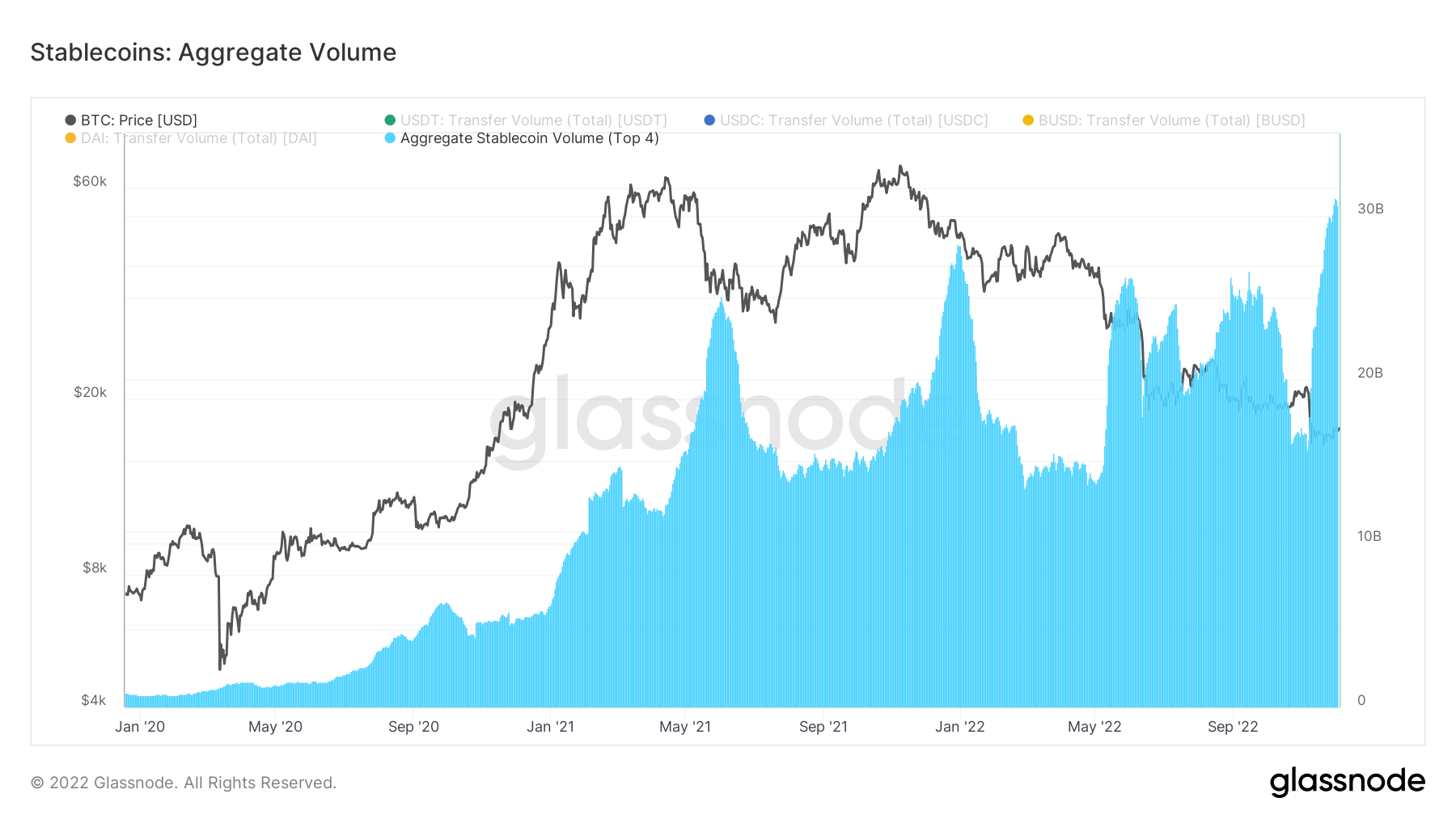

Stablecoin aggregate volume reaches ATH

Citing Glassnode data, Clemente said stablecoin’s growth was evident in several areas. This included the aggregate volume reaching an all-time high despite the crypto winter.

The Glassnode chart below shows that the aggregate volume for the top 4 stablecoins surpassed $30 billion recently.

Source: Twitter

According to the chart, stablecoin’s aggregate volume within the past year first spiked above $20 billion during the Terra LUNA collapse around May and June.

While it spiked above the mark around September too, it dropped below $20 billion in October. However, the recent FTX implosion has seen it surge above $30 billion.

Stablecoin aggregate supply on the up

The aggregate supply for stablecoin is also close to an all-time high, according to Glassnode data.

The aggregate supply reached an all-time high of over $150 billion earlier in the year before the Terra-related market crash. While the decline has steadily declined since then, the supply is still above $100 billion.

For context, the supply for Binance-backed BUSD grew from $18 billion at the start of the year to over $22 billion. USD Coin (USDC) supply also crossed the $50 billion mark earlier in the year before dropping to its current levels.

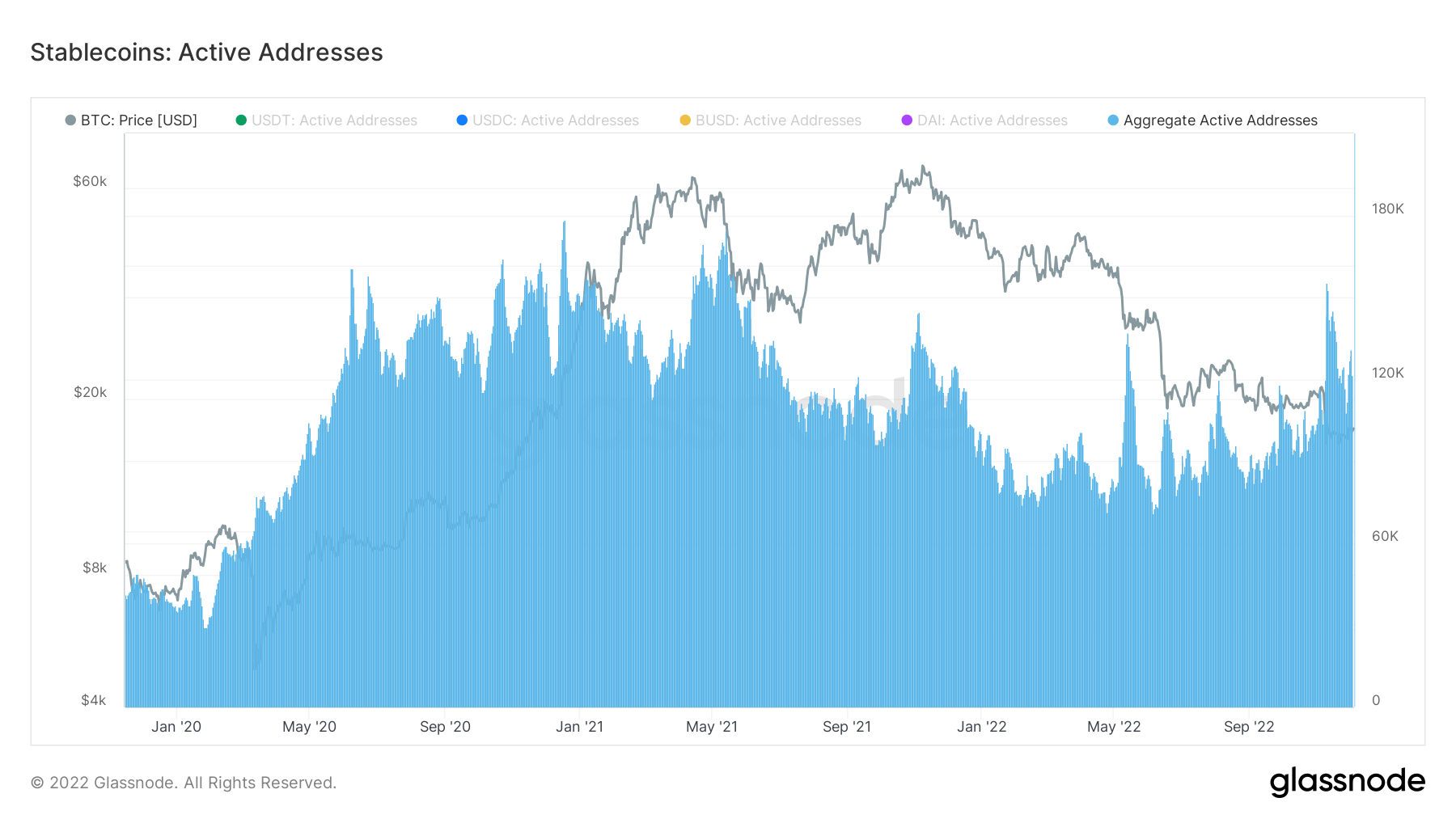

Stablecoin active addresses rise

Meanwhile, the number of stablecoin active addresses has returned to its 2021 peak. In May 2021, there were over 150,000 aggregate active addresses.

However, the number of active returned to that level during the second half of 2022 as the crypto investors dealt with the fallout of Terra’s crash and FTX’s implosion.

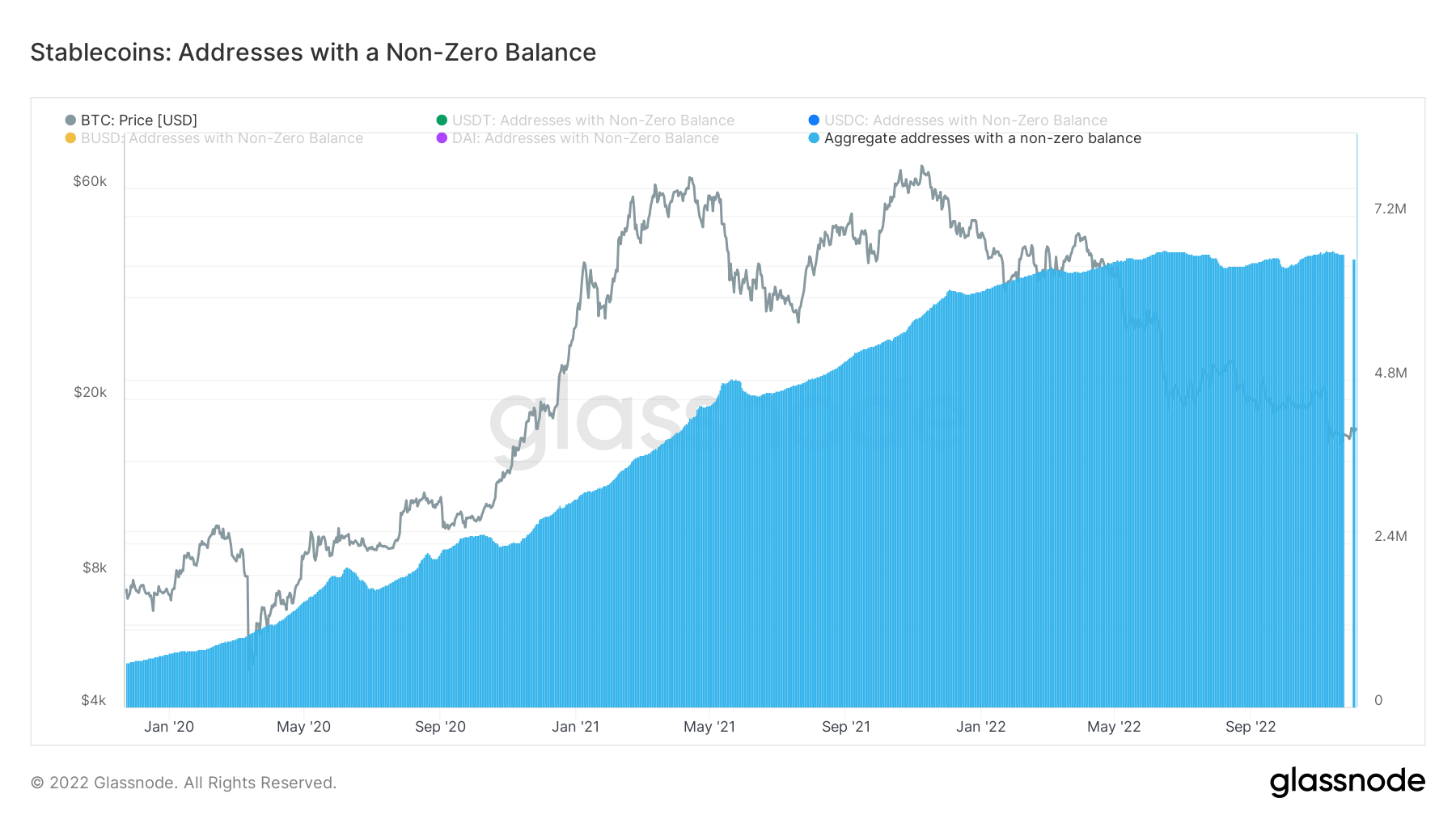

Meanwhile, the number of addresses with a non-zero balance is also at its peak presently at over 6 million.

Clemente believes all of this was because of stablecoin use cases, which included “capital efficiency in crypto, giving access to USD to those without banking, among other reasons.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur