Super Micro Computer (SMCI Stock) – Price Creates All-Time High

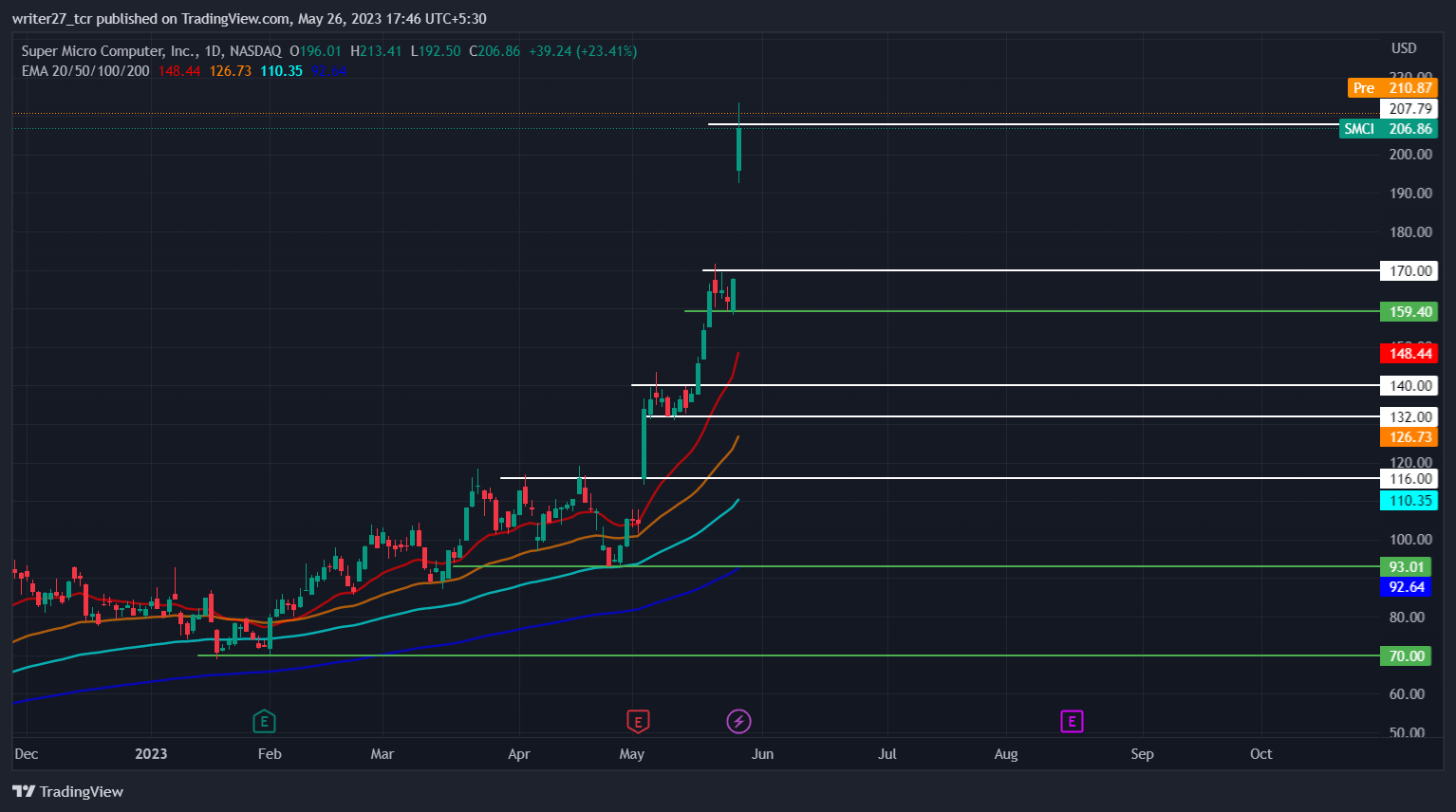

- 1 Super Micro computer price closed at $206.86 while witnessing a gain of +23.41% during the last trading session.

- 2 SMCI price trades above 20,50,100, and 200-day.

- 3 The year-to-date return of SMCI price is 148.99%.

At the start of May, SMCI prices escaped the consolidation zone ranging between $93 and $116. The stock price has been in a consolidation zone since the mid of March and after the release of the earning report for quarter 3, 2023.

SMCI stock breached the resistance level and formed an annual high of $213.41. The IT solution company has been on an uptrend since the start of 2023.

The super micro computer has recently teamed up with Applied Digital to deliver AI cloud services, which helped the price gain bullish momentum to break the minor consolidation zone of $159.40 and $170.

Source: SMCI Stock Price By TradingView.

On May 22, Super micro computer launched a new Nvidia HGX rack scale and liquid cooling technologies to expand its data center offerings.

Many developments are going on around Super Micro Computer, which has led to price gaining bullish momentum and creating an all-time high.

Super Micro Computer Earning Report Q3

Super Micro Computer(SMC) reported net income of $85.85 Million on a revenue of $1.28 Billion which was lower than the last quarter. The earnings per share could not beat the consensus estimate of $1.71 and turned out to be $1.63, a surprise of -0.08(-4.57%).

SMC CEO stated that demand for gear that can handle generative AI is on the rise, which led to a component shortage and pushed some orders out of the quarter.

The issue has been addressed, and the company started producing and shipping back orders since April. The stock price has been reflecting the developments in the company and is still bullish.

Will SMCI Stock Price Reach $250 ?

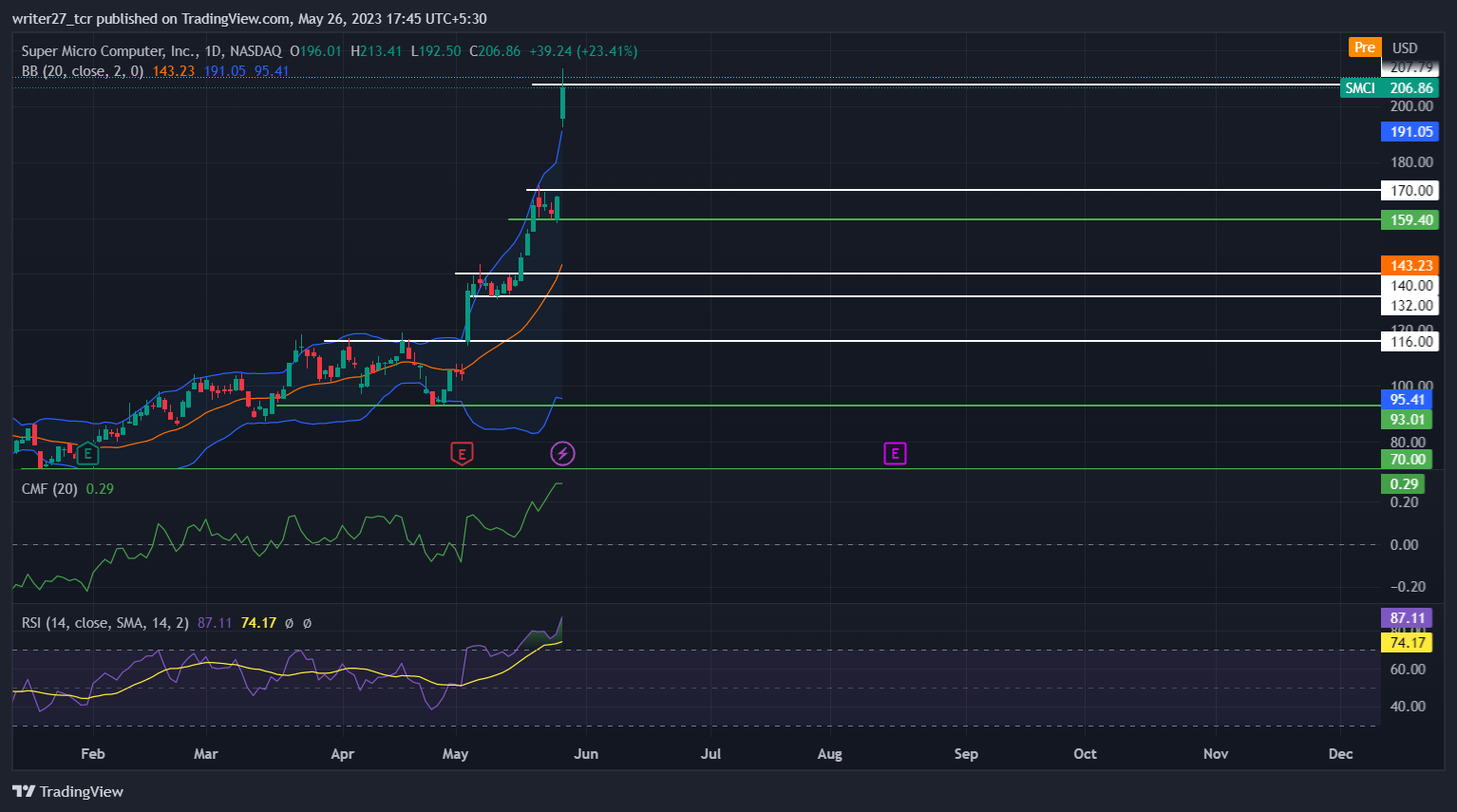

Source: SMCI Stock Price by TradingView.

SMCI price traded above 20,50,100 and 200-day EMAs, indicating a bullish momentum in the price. Chaikin money flow score is 0.27, showing strong bullish strength in the market. However, the RSI closed at 87.11, residing in the overbought zone, indicating a chance of a pullback.

The momentum is strong, and a trend reversal is far from the horizon. If the price stays below the $210 level, there is a chance of a pullback in the price to the $200 level.

SMCI price has been residing near the upper band of Bollinger since the start of May without even a pullback to 20-day SMA, indicating how strong is the momentum for the price. Currently, there is no confirmation for selling the stock.

Traders should wait for the SMCI price to retrace and form support before looking for bids, as the bullish rally has already taken off.

Conclusion

The market structure and price action for Super Micro Computer is highly bullish. The technical indicator suggests a chance of a pullback. Let’s see where the price might head from here after showing strong bullish momentum.

Technical Levels

Major support: $170 and $180

Major resistance: $220 and $240

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polygon

Polygon  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Monero

Monero  Hedera

Hedera  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Stacks

Stacks  Cronos

Cronos  Maker

Maker  Theta Network

Theta Network  EOS

EOS  Algorand

Algorand  Gate

Gate  KuCoin

KuCoin  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Zilliqa

Zilliqa  Zcash

Zcash  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Dash

Dash  Decred

Decred  Siacoin

Siacoin  Ontology

Ontology  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  NEM

NEM  Nano

Nano  Pax Dollar

Pax Dollar  Waves

Waves  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Energi

Energi  Augur

Augur