Why the MATIC price could fall toward $0.60 in October

- MATIC price has rallied 20% since the middle of September.

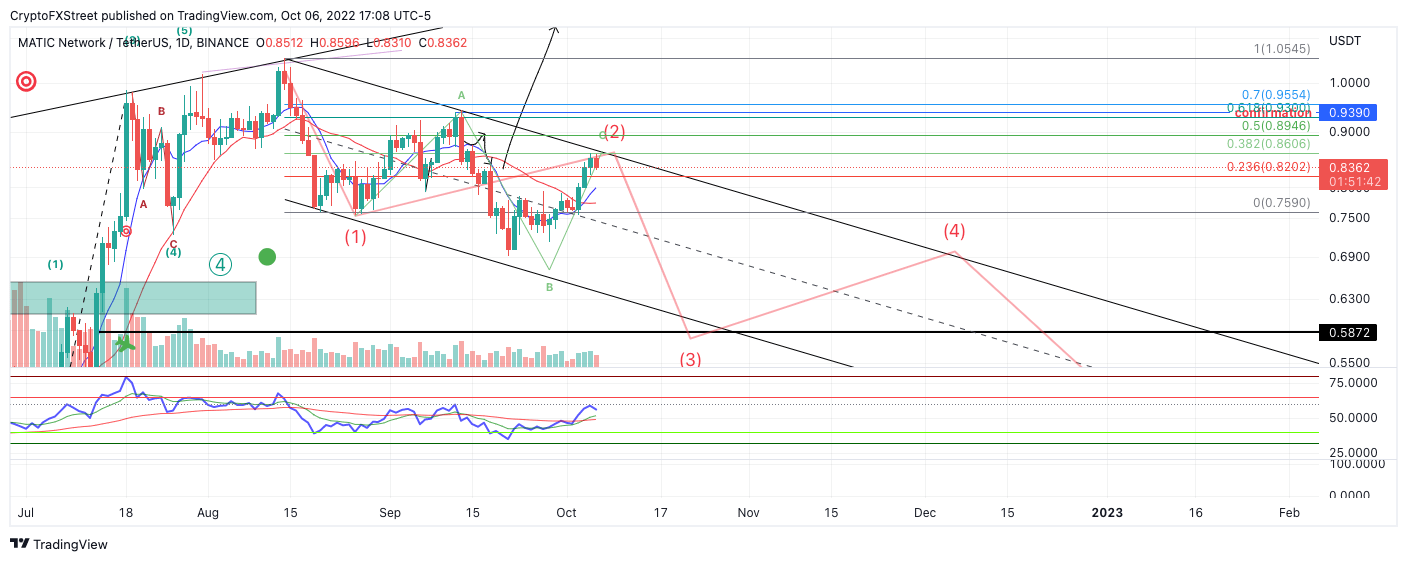

- Polygon price faces significant resistance near the upper bounds of a descending trend channel.

- Invalidation of the bearish thesis is a breach above $1.05.

MATIC price could witness a sweep-the-lows-liquidation event in the coming weeks. Key levels have been identified.

Matic price shows multiple bearish signals

Matic pride shows a few factors suggesting the uptrend may be waning. Since the middle of September, MATIC has rallied 20%. The Volume Profile Indicator shows a very sparse reading in contrast with the previous MATIC bullrun during the summer. The indicator could suggest that the uptrend is losing strength.

Matic price currently auctions at $0.83. In addition to the low volume, the Relative Strength Index affirms that the uptrend is in jeopardy. Before the current uptrend rally, MATIC bottomed out in the oversold territory. MATIC now faces a key resistance level that forged the last decline at $0.93 into the lows at $0.69. There is also a divergence between the highs.

MATIC/USDT 1-Day Chart

Combining these factors, Polygon’s MATIC price could set up a sweep-the-lows event targeting the $0.60 congestion zone established in June. Said price action would result in a 25% decline from the current price levels.

Invalidation of the bearish thesis can occur if the bulls hurdle the swing high at $1.05. Traders with a heavier risk tolerance could also use the $0.91 swing high. If the bulls manage to breach the $0.91, a rally toward $1.20 would be on the cards. Such a move would result in a 45% increase from the current MATIC price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur