Инвестидея: Ставка на приватность в сфере криптовалют

Популярный аналитик TradingView Андрей Гориславко (Age_of_Crypto) оценил перспективы криптовалюты SCRT и рассказал о прибыльной стратегии при работе с активом

«РБК-Крипто» не дает инвестиционных советов, материал опубликован исключительно в ознакомительных целях. Криптовалюта — это волатильный актив, который может привести к финансовым убыткам.

Secret Network (SCRT) — это уникальная блокчейн-платформа, которая предлагает функциональность «тайных» контрактов. Вот некоторые ключевые аспекты, которые делают эту криптовалюту привлекательной для инвесторов:

- Приватность по умолчанию: Secret Network вводит понятие «тайных контрактов», которые зашифрованы с использованием технологии доказательств с нулевым раскрытием. Это означает, что внутренние состояния контракта, включая баланс и транзакции, остаются приватными и не могут быть просмотрены никем, включая валидаторов сети.

- Поддержка децентрализованных финансов (DeFi): Важным направлением для Secret Network являются приложения DeFi. Приватность является важным элементом в секторе DeFi, и Secret Network предлагает решения, которые могут сделать DeFi более безопасным и приватным.

- Децентрализация: Secret Network является полностью децентрализованной платформой с участием множества валидаторов.

- Рост и развитие: На самой ранней стадии развития были такие громкие сотрудничества, как с Intel. Secret Network продолжает развиваться и расширяться, с новыми партнерствами и проектами, что увеличивает потенциал SCRT.

- Токен ENG (SCRT) в 2020 году входил в ТОП 20 монет HODL у участников генезис-блока и топ-250 кошельков ETH.

ICO проекта Enigma (ENG) успешно прошло в сентябре 2017 года. В ходе сбора средств не проводилась процедура «знай своего клиента» (KYC). В феврале 2020 года создатели Enigma запустили основную сеть (mainnet), но вскоре начались претензии регуляторов. Регулятор SEC заставил Enigma вернуть американским инвесторам $45 млн, привлеченных в ходе ICO. Дополнительно компания заплатила штраф в размере $500 тыс. Также последовало предписание зарегистрировать свои токены ENG в качестве ценных бумаг, и они согласились с претензией SEC. Решение SEC заставило Enigma пересмотреть структуру и стратегию, что привело к рождению Secret Network с новым токеном SCRT и переориентацией с блокчейна Ethereum на Cosmos SDK / Tendermint.

Многие знакомы только с анонимными криптовалютами, но Secret предлагает возможность создания анонимных смарт-контрактов, что обязательно найдет применение в различных областях. Основной функцией Secret является анализ данных без доступа к самим необработанным данным. Например, группа людей может предоставить данные о заработках и вместе вычислить среднюю зарплату в группе. Каждый участник будет знать свое относительное положение в группе, но не будет знать о зарплатах других участников. Это просто один из многочисленных примеров.

Прозрачность является значительным препятствием для многих при внедрении блокчейна. У всех есть доступ ко всему. Пользователи могут отслеживать транзакции и получать доступ к некоторым другим данным. Если вы однажды использовали свой кошелек на Ethereum (ETHUSD), то становитесь доступны для наблюдения, так как все ваши активы, привязанные к кошельку, смарт-контракты, а также все последующие входящие и исходящие транзакции становятся видимыми. Это вызывает озабоченность у многих пользователей. Развитие сегмента Web3 требует конфиденциальности, и проекты типа Secret могут помочь в этом.

Решил обратить на проект внимание именно сейчас, так как последние новости показывают, что в течении 2023 года придет более серьезная регуляция:

- Налоговое управление США (IRS) планирует ввести требование обязательной идентификации пользователей (KYC) на всех криптобиржах в этом году.

- Биржа ByBit ввела обязательное условие «знай своего клиента» (KYC) с 8 мая.

- Биржа Bitfinex объявила об обязательной верификации до 21 июня.

- Биржа Hotbit приостановила работу и попросила пользователей вывести свои оставшиеся активы до 21 июня, ссылаясь на сложности в работе из-за регуляторов.

Возможно, мы скоро увидим, как рынок будет разделен на две части: полностью прозрачную и анонимную. Проекты типа Secret, вероятно, начнут набирать популярность.

Secret Network считается одним из лидирующих проектов, обеспечивающих приватность и безопасность в блокчейн-индустрии. Это достаточно сложный и хорошо масштабируемый продукт с небольшой текущей капитализацией, всего $100 млн. Сеть основного уровня (mainnet) успешно функционирует несколько лет, предоставляя возможность анонимной передачи, обработки и продажи данных. SCRT активно торгуются на различных криптобиржах и имеет значительный потенциал для роста. Возврат денег инвесторам по решению SEC, выплата штрафа и выпуск нового токена — можно рассматривать как очистку перед SEC, что возможно еще предстоит сделать многим проектам.

С апреля 2021 года Secret Network является частью сети Cosmos IBC и входит в число 59 текущих зон, что делает его составной частью «Интернета блокчейнов» Cosmos.

Сеть Secret предлагает ряд рабочих приложений, каждое из которых ставит конфиденциальность на первое место:

- Alter — это приватное и безопасное приложение для обмена сообщениями, проект обеспечивает способ защиты личных и профессиональных дискуссий.

- Shade Protocol — предлагает различные DeFi-приложения, обеспечивающие приватность, такие как их Shade Bridge или Shade Swap. Это позволяет пользователям осуществлять финансовые операции без страха перед утечкой их личной информации.

- SiennaSwap — это кросс-чейн DeFi-платформа. Обмен, кредитование и конвертация, все это осуществляется приватно. В мире, где все больше и больше внимания уделяется интероперабельности, SiennaSwap демонстрирует, как приватность может быть интегрирована в этот растущий тренд.

- SecretSwap — это децентализованная биржа (DEX), устойчивая к фронтраннингу и работающая в нескольких блокчейнах. У него есть мосты к Ethereum, Monero и BSC, что демонстрирует его способность работать в рамках более широкого экосистемного подхода.

Эти приложения являются лишь некоторыми из многих, которые уже разработаны или находятся в процессе разработки в Secret Network. Они иллюстрируют способность Secret полноценно развернуться в сегменте Web 3.0, где приватность становится не просто дополнением, а фундаментальной частью.

Покупка

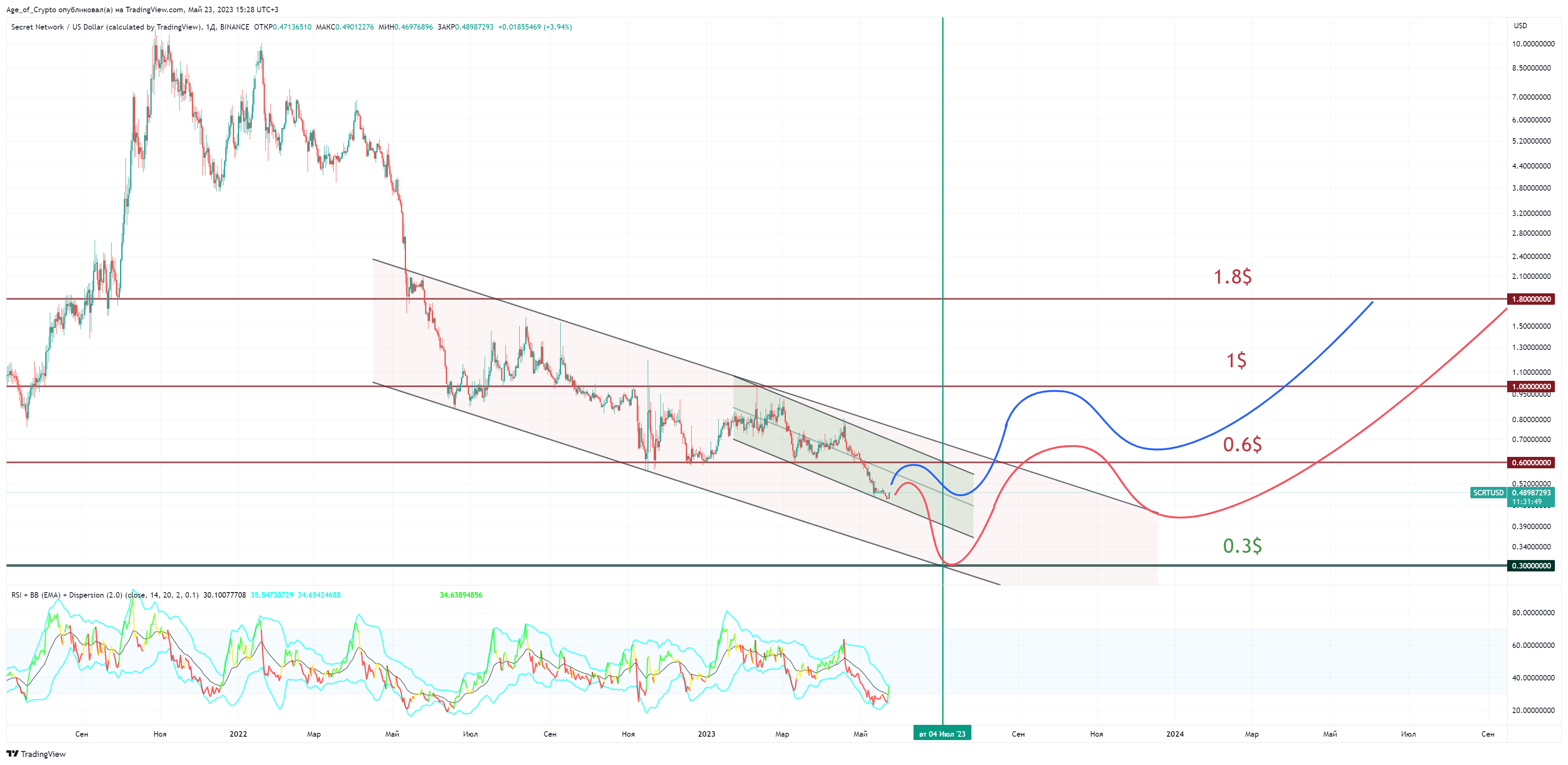

Дневной график SCRT/USDT на бирже Binance. Источник: TradingView

Осенью 2021 года стоимость SCRT достигала $10, сейчас монета торгуется по $0,48. Судя по графику циркуляции монет (Market Supply), в середине апреля было разблокировано 25% монет. Это последний месяц оказывает давление на цену. На дневном таймфрейме монета торгуется в среднесрочном нисходящем трендовом канале, в котором сформирован краткосрочный трендовый канал.

Локально жду роста, по итогам которого определится один из двух наивероятных сценариев. Если будет тест $0,6 и потом начнет формироваться фигура двойного дна, ожидаю развития синего сценария, можно покупать по цене $0,48, равной текущей. Можно покупать сейчас от текущего уровня с коротким стоп-лоссом.

Если покупатели не проявят силы и отскок будет незначительный, то вероятнее увидеть красный сценарий и ждать цены 0.3$, где сформирован исторически сильный уровень покупателей. Монета фундаментальная, долгосрочные цели можно ждать выше, но на текущем рынке фиксировать буду при достижении $1,8 и делать дополнительный анализ.

Важно помнить, что вложение в SCRT, как и в любые другие криптовалюты, связано с рисками.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur