Приток Ethereum в стейкинг впервые превысил объемы вывода

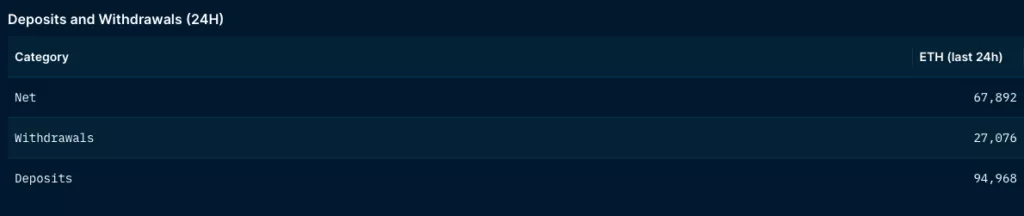

За последние сутки сумма депозитов в стейкинг Ethereum (94 968 ETH) впервые с момента активации хардфорка Shapella превысила объемы вывода (27 076 ETH). Об этом свидетельствуют ончейн-данные Nansen.

Соотношение депозитов и вывода ETH. Данные: Nansen.

Большая часть депозитов приходится на протокол Lido Finance — 30,9%. Следом идут биржи Coinbase (12,8%) и Kraken (6,8%).

В общей сложности после обновления в стейкинг добавлено 472 000 ETH. На момент написания пользователи уже вывели около 1,06 млн ETH.

Всего в сети заблокировано 18,68 млн ETH, включая вознаграждения — это составляет 14,5% от рыночного предложения монеты. В очереди на снятие находится 912 137 ETH.

Согласно данным Token Unlocks, из стейкинга ежедневно выводится $61,6 млн. Средняя цена покупки монет в стейкинге — $2137.

Эксперты Lookonchain зафиксировали, что кит с адресом satofishi.eth снял из разблокировал 15 886 ETH (~$33 млн) и перевел 1420 ETH (~$3 млн) на криптобиржу Binance.

satofishi.eth (@satofishi) withdrew 15,886 $ETH($33M) and transferred 1,420 $ETH($3M) to #Binance 13 hrs ago.https://t.co/sIxwiLOQLj pic.twitter.com/58GLkSYm3W

— Lookonchain (@lookonchain) April 18, 2023

В беседе с The Block аналитики Grayscale Мэтт Максимо и Майкл Чжао отметили, что вывод эфира из стейкинга происходит медленнее, чем ожидалось. Однако, по их мнению, в перспективе объем разблокированных средств продолжит расти.

«Мы считаем, что краткосрочное влияние обновления Shanghai на цену будет менее серьезным, чем первоначально предполагалось, из-за меньшего количества снятий и полных выходов ETH. Забегая вперед, мы думаем, что это бычье событие для Ethereum, поскольку снижение рисков стекинга может повысить базовый спрос на актив», — добавили эксперты.

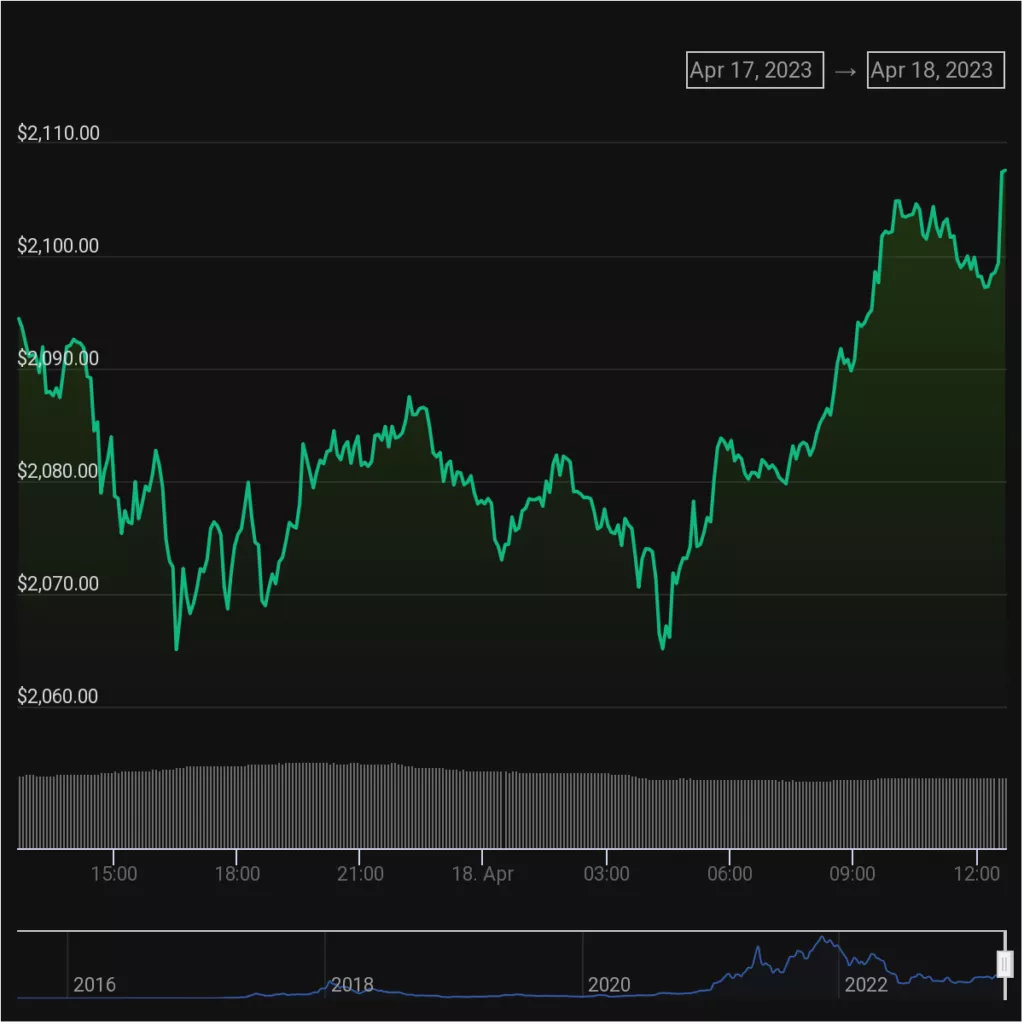

Согласно данным CoinGecko, ETH торгуется по $2106, за сутки прибавив 0,9%.

График Ethereum. Данные: CoinGecko.

Напомним, криптобиржа Binance откроет вывод ETH из стейкинга с 19 апреля, в 5:00 (Киев/МСК).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren