Математика Сатоши: как работает система Биткоина

Более 14 лет назад Сатоши Накамото представил миру сеть Биткоин, создав самую первую систему бухгалтерского учета с тройной записью. Это технологическое чудо, объединяет шифрование и математические формулы для повышения безопасности. В основе сложной архитектуры Биткоина есть несколько математических подходов, которые определяют вознаграждение за блок, входы и выходы транзакций и корректировки сложности майнинга, а также регулирует скорость, с которой обнаруживаются новые блоки. Система Биткоина работает на основе математики Сатоши.

Целые числа в действии: взгляд на использование целых чисел

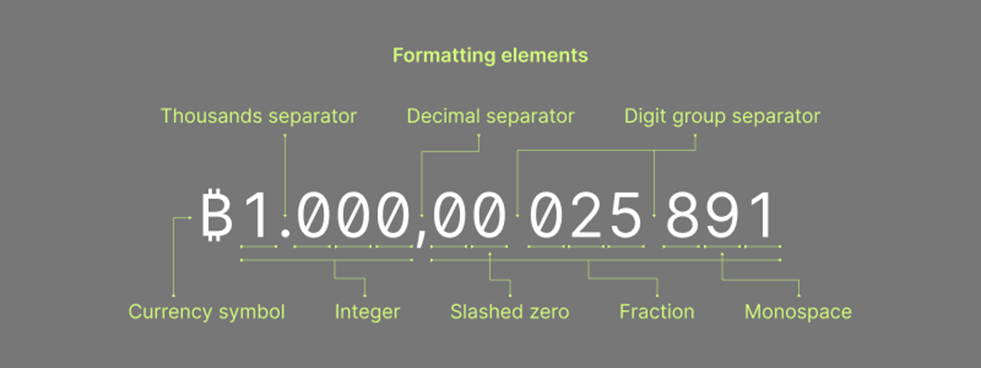

Биткоин был создан с использованием различных процессов шифрования и математических формул, каждая из которых имела определенную цель. Одним из элементов дизайна, включенных в Биткоин, является использование целых чисел или целых чисел и их отрицательных аналогов.

Сеть Биткоина использует целочисленную математику, чтобы предотвратить потенциальные разногласия, которые могут возникнуть при использовании десятичных или дробных чисел. Использование целых чисел и их отрицательных аналогов гарантирует более эффективную синхронизацию всех вычислительных устройств и согласование конкретных сетевых изменений.

Использование целых чисел для поддержания набора правил Биткоина включает вознаграждение за блок и деление пополам, которое происходит при определенной высоте блока, кратной 210 000.

Сложность майнинга Биткоинов также использует целые числа для корректировки сложности каждые 2016 блоков. Целые числа, тип числовых данных, часто используемый в вычислительном программном обеспечении, также используются для ввода и вывода биткоин-транзакций.

Кроме того, целочисленные вычисления, как правило, быстрее и менее подвержены ошибкам, чем числа с плавающей запятой. Если бы Биткоин использовал числа с плавающей запятой, это могло бы привести к ошибкам округления, что привело бы к несоответствиям и разногласиям между различными узлами в сети.

Поскольку Биткоин спользует целые числа, вознаграждение за блок от будущего деления пополам в конечном итоге будет усечено или округлено до ближайшего целого числа с использованием операторов битового сдвига или побитовой операции. Поскольку наименьшая единица Биткоина — это сатоши, разделить ее вдвое невозможно. В результате, широко обсуждаемый ограниченный запас Биткоинов фактически составит менее 21 миллиона.

Регулирование времени блока с помощью распределения Пуассона и система Биткоина

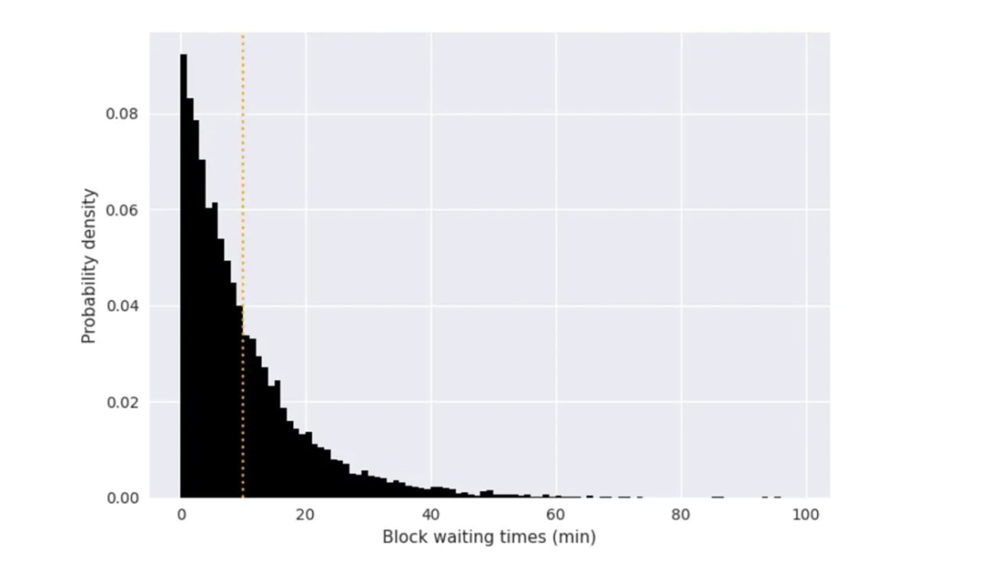

В дополнение к целым числам Биткоин использует математическую формулу, подобную распределению Пуассона, для регулирования согласованности времени блока. Модель распределения Пуассона была разработана в 1837 году французским математиком Симеоном Дени Пуассоном. Используя эту модель, конструкция Биткойна гарантирует, что блоки обнаруживаются каждые 10 минут или около того.

Фактическое время, необходимое для майнинга блока, может варьироваться из-за вероятностного характера процесса майнинга, но обычно блоки находятся в диапазоне от 8 до 12 минут. Сатоши включил настройку сложности каждые 2016 блоков, используя формулу для поддержания примерного среднего значения 10-минутных интервалов между блоками.

Как целочисленная математика, так и распределение Пуассона являются важными математическими инструментами в Биткоине, обеспечивая согласованную основу для выполнения вычислений и моделирования различных аспектов системы.

Биткоин использует множество других математических механизмов и схем шифрования для обеспечения точности, согласованности и эффективности системы в целом. К ним относятся такие понятия и формулы, как:

- доказательство работы (PoW),

- деревья Меркла,

- криптография на эллиптических кривых,

- криптографические хэш-функции и конечные поля

Автор: Вадим Груздев, аналитик Freedman Сlub Crypto News

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Zcash

Zcash  Theta Network

Theta Network  Tether Gold

Tether Gold  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Status

Status  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Hive

Hive  Waves

Waves  Lisk

Lisk  NEM

NEM  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD