В 2023 году капитализация стейблкоинов сократилась на $ 7,3 млрд

В 2023 году в экономике стейблкоинов произошло снижение стоимости на $ 7,3 млрд: 6 января эта цифра равнялась $ 138,12 млрд, но на сегодняшний день она сократилась до $ 130,79 млрд.

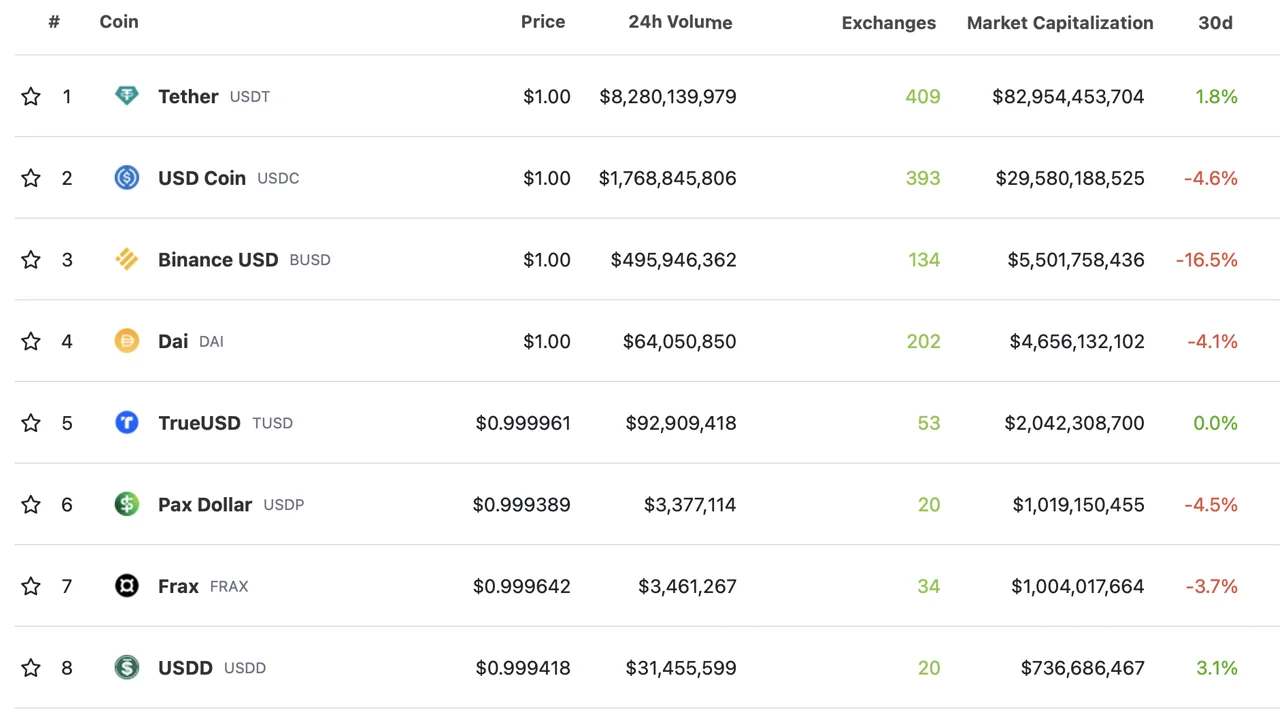

Примечательно, что за последние четыре месяца некоторые проекты стейблкоинов понесли значительные погашения, при этом только USDC потерял более $ 14 млрд. Аналогичным образом с первой недели января BUSD потерял $ 11 млрд, в то время как DAI лишился $ 361 млн.

Топ-8 стейблкоинов по рыночной капитализации на 21 мая 2023 года.

Тем не менее, другим проектам стейблкоинов удалось компенсировать общие потери за счёт роста. К примеру, TUSD, который начал год с рыночной капитализацией примерно в $ 846,57 млн, сегодня имеет общую стоимость в $ 2,04 млрд (прирост составил 140,97%).

Главный стейблкоин Tether (USDT) также стал свидетелем значительного увеличения своей рыночной капитализации. Ещё в первую неделю января USDT имел соответствующий показатель в $66,29 млрд, но с тех пор он вырос более чем на 25%, достигнув $ 82,95 млрд.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Status

Status  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur