Децентрализованные биржи уже вытесняют централизованные

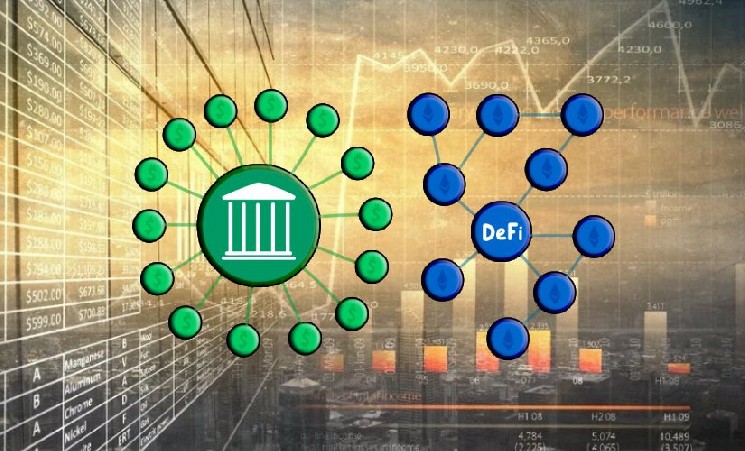

Эксперты компании Citi Group заверили, что ужесточение регулирования криптовалют может привести пользователей к использованию децентрализованных торговых платформы (DEX). Он постепенно начали вытеснять централизованные биржи (CEX). Аналитики отметили, что рост первых происходил значительно быстрее за последние 2 года. Такие данные были предоставлены в отчете компании о секторе.

По словам экспертов, пользователи уже постепенно начали уходить с централизованных платформ, чтобы избежать обременительных процедур верификации личности KYC (знай своего клиента). В отчете сказано, что помимо прочего, DEX предоставляют распределенные доходы, такие как дивиденды держателям токенов и возможность самостоятельного хранения средств. Кроме того, подобные площадки предлагают существенно более низкие комиссии, чем такие платформы, как Coinbase Pro или Binance.

По словам экспертов банка, одним из основных различий между DEX и CEX является способ хранения средств. На децентрализованных площадках это не сопряжено с рисками. В пример были приведены крах кредитной платформы Celsius Networks и брокера Voyager Digital .

Одним из потенциальных факторов роста объемов DEX в ближайшей перспективе станет усиление надзора за криптовалютной отраслью. По мере того, как начнет требоваться все больше отчетности о деятельности торговых площадок, юзеры будут переходить на DEX, чтобы обезопасить конфbденциальность собственных данных. По состоянию на 3 октября 2022 года на децентрализованные платформы приходится 18,2% от общего объема спотовой торговли. Доминировала биржа Uniswap.

Ранее редакция Crypto.ru сообщила: глава Binance Чанпен Чжао (CZ) заверил в том, что сектор децентрализованных финансов начнет вытеснять CEX в течение ближайших 10 или 20 лет.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Stacks

Stacks  KuCoin

KuCoin  Maker

Maker  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Waves

Waves  Nano

Nano  Hive

Hive  Status

Status  NEM

NEM  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Ren

Ren  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD