APECoin Price Analysis: APE Bulls are Ready to Push the Price Towards Ideological Round Levels of $10

- APECoin price traded above the previous swing high as well as being up 37% higher this week.

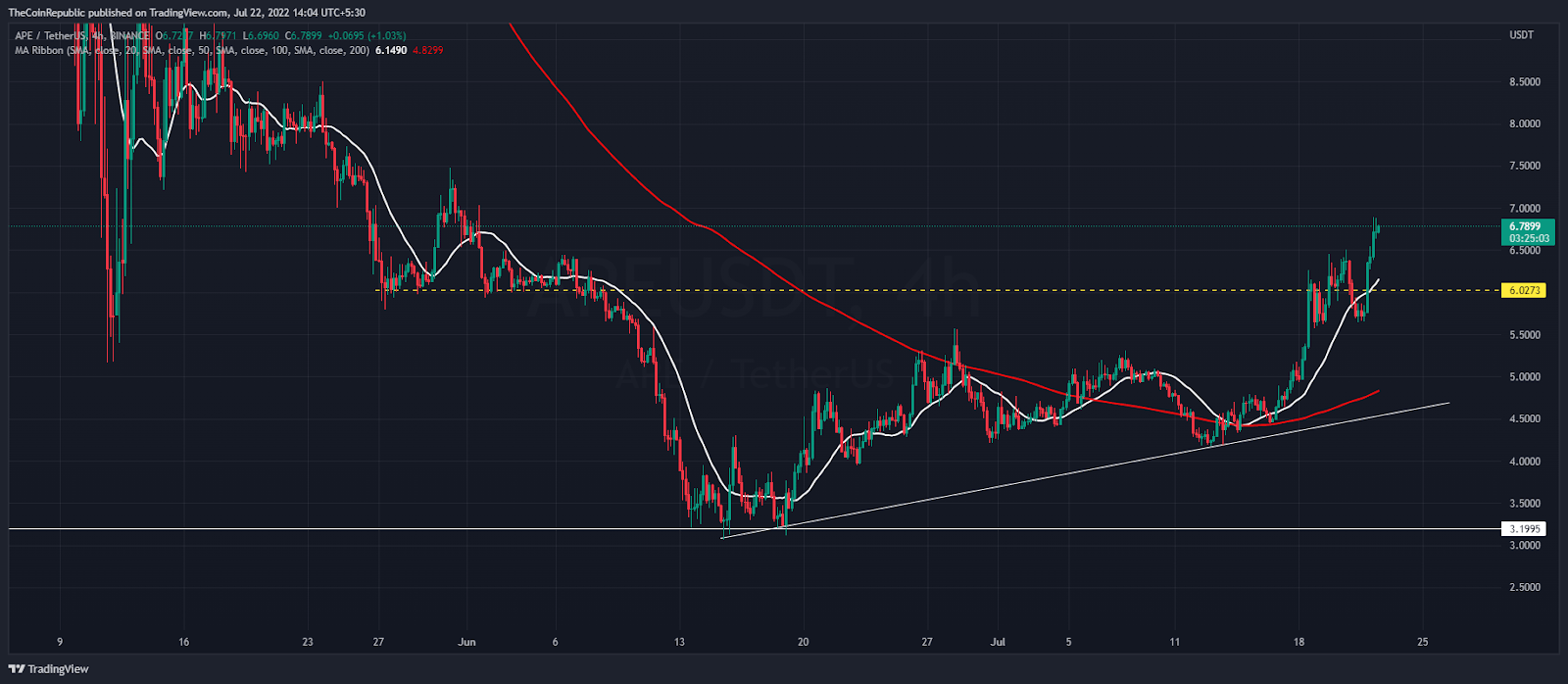

- The 20 day moving average is showing below APE price in the 4-hours price graph.

- The RSI indicator is moving towards an overbought zone.

The APECoin’s price has broken out of its previous downward trend. The price of APECoin (APE) has increased by 50% in the last week, dominating the $6 level. Along with rising demand, there are rumors of a potential price comeback above the $7 resistance level. However, during the intraday trading session, the price reached a 50-day high of $6.88.

APECoin price action shows a high-low formation after reversing from the June lows. Continuing the uptrend, buyers had an upward trendline (bottom of the chart), which is still valid for the upcoming sessions.

Source: APE/USDT by Tradingview

Amidst the uptrend, the price of APECoin is above the previous weekly swing high, while this week is up 37%. At the same time, at the time of writing, altcoin was trading at the $6.7 mark. Thus, the market cap of the APE token is up 15% to $2 billion, according to data from CMC over the past 24 hours.

During the 4-hours price graph, the 200-day moving average (red) rose below the APE token price. In the midst of a move towards the conceptual round level of $10, the 20 DMA is acting as an immediate support. Furthermore, the trading volume gradually decreases relative to the ongoing trend.

Buyers Looks Aggressive for Higher Momentum

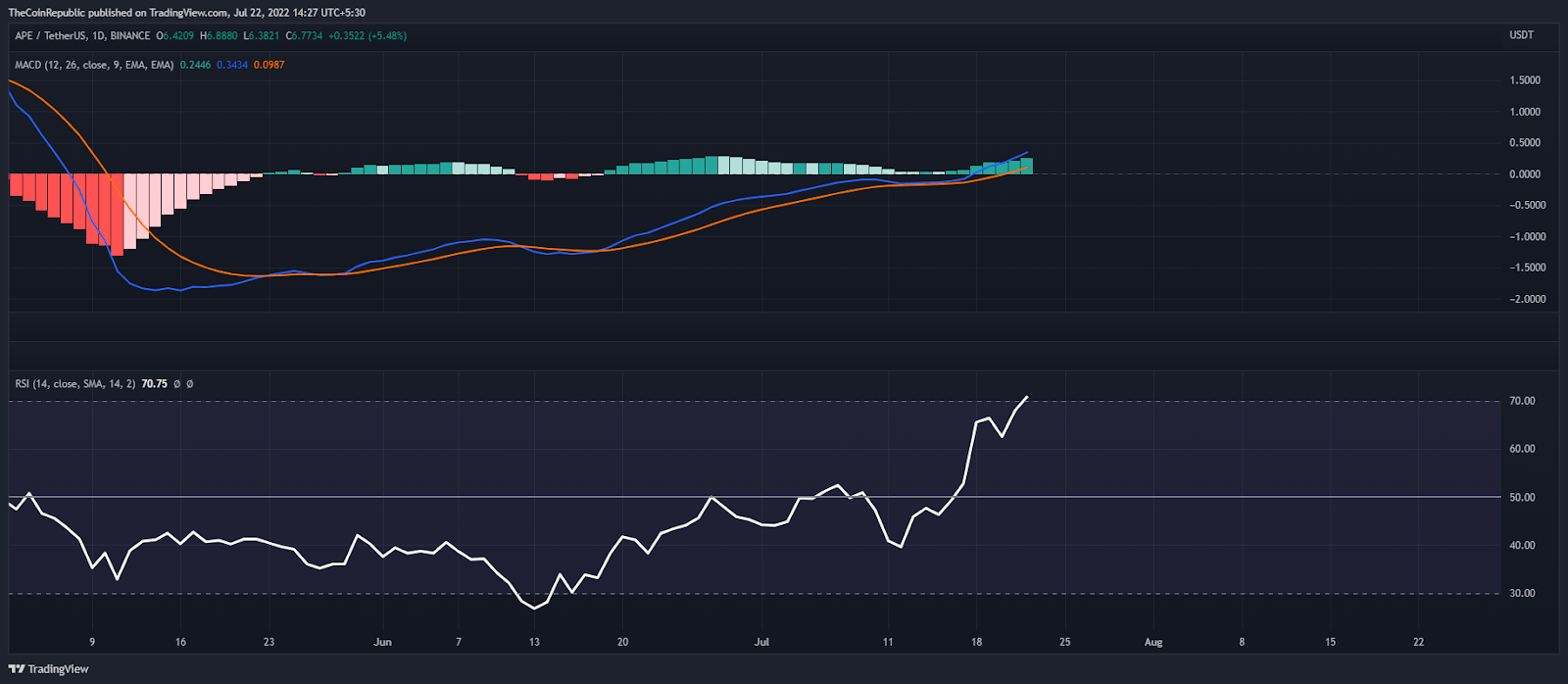

Source: APE/USDT by Tradingview

The RSI indicator is moving towards the highly overbought area while the semi-line is the key support level for the given indicator. Similarly, the MACD also moved above the neutral zone with the green histogram rising.

Conclusion

APECoin price broke the crucial bullish barrier of $6.0 which acted as a support level. Now the bulls are pushing the price of the APE token towards the $7.0 resistance level. Furthermore, traditional indicators favor a bullish trend.

Support level- $5.0 and $4.0

Resistance level- $7.0 and $10

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD