Аналитики спрогнозировали выход биткоина из текущего ценового диапазона

Учитывая чрезвычайно низкую волатильность и узкие торговые диапазоны, сложившееся равновесие на рынке биткоина вскоре будет нарушено. Такую оценку дали аналитики Glassnode.

The latest Week On-chain edition is live!

We analyse a #Bitcoin market that looks primed for a regime of higher volatility in the near-term.

With little clear gravity in either direction, we bound the problem using key psychological price models.https://t.co/mLfWPD2O5t pic.twitter.com/q3kXzRlK8y

— _Checkɱate ?⚡?☢️?️ (@_Checkmatey_) May 29, 2023

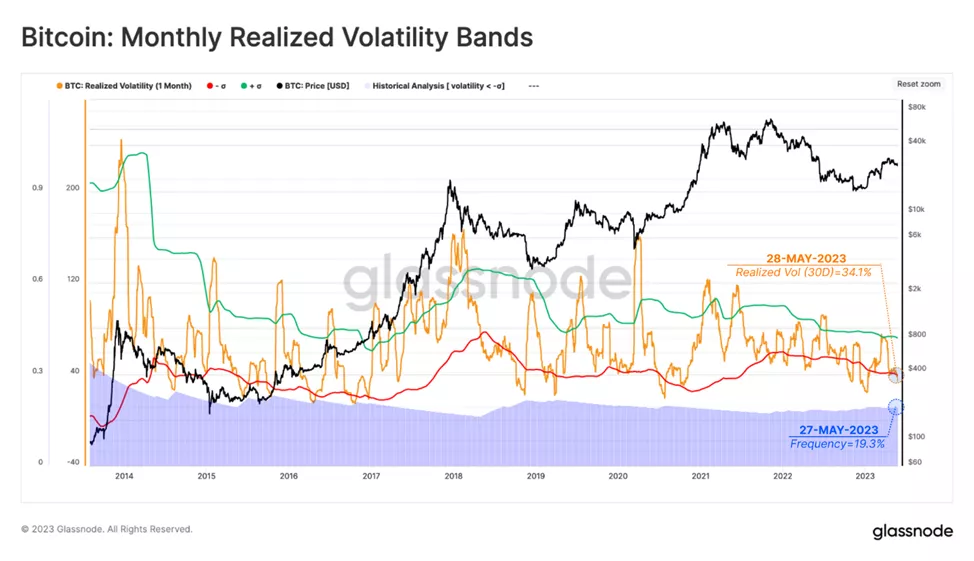

Показатель месячной реализованной волатильности опустился до 34,1%, что ниже одного стандартного отклонения полос Боллинджера. На подобные периоды низкой волатильности приходится всего 19,3% истории рынка.

Данные: Glassnode.

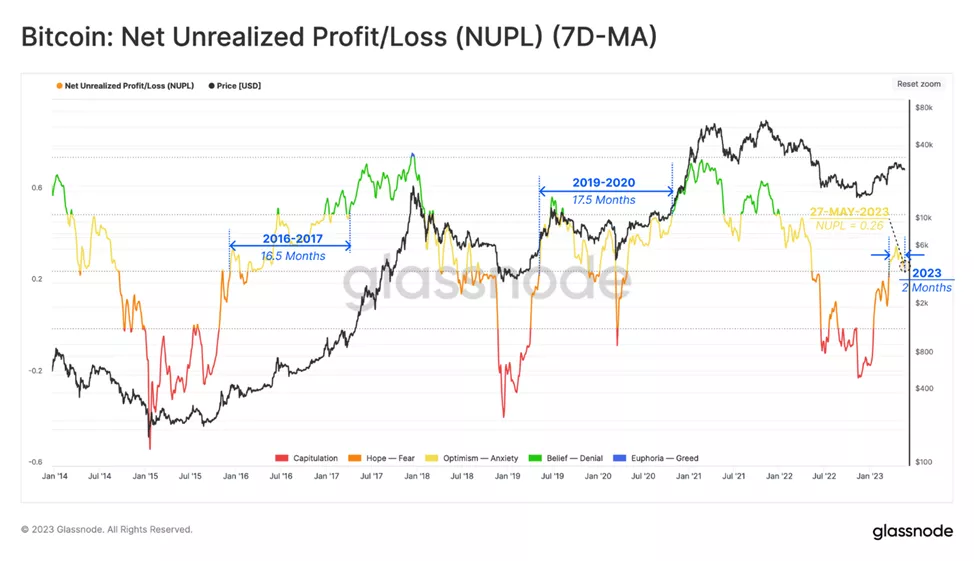

Более низкая волатильность и снижение переданной ончейн стоимости указывают на фазу равновесия. Это подтверждает индикатор Net Unrealized Profit/Loss (NUPL), значение которого (0,29) соответствует подобным стадиям развития цикла (от 0,25 до 0,5). В предыдущие два похожих эпизода такое состояние продлилось около 16 месяцев. NUPL перешел в эту зону в марте 2023 года.

Данные: Glassnode.

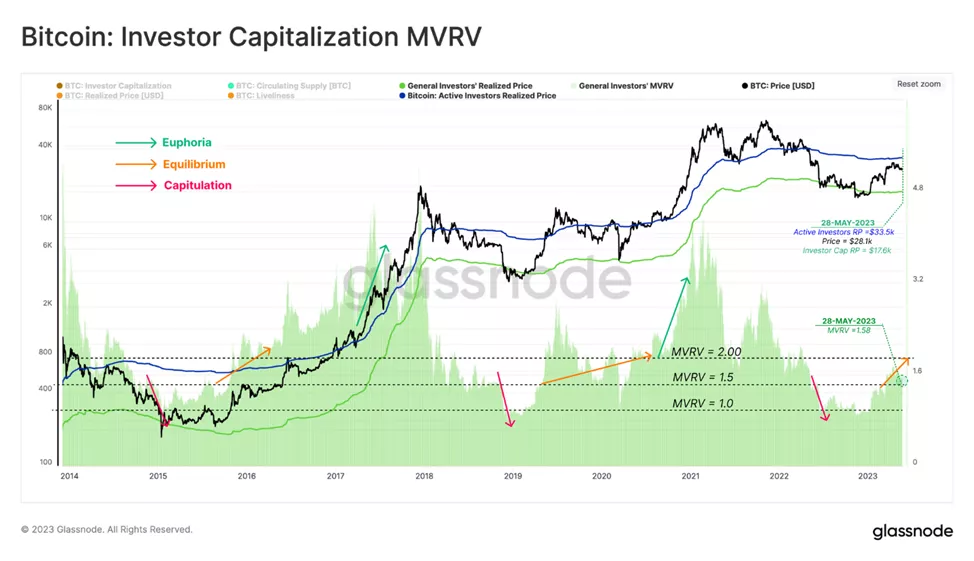

«Себестоимость» приобретенных активными инвесторами монет составляет $33 500. По мнению специалистов, этот уровень может выступить верхней границей текущей консолидации. MVRV этой категории участников рынка составляет 0,83 — многие покупатели в цикле 2021-2022 годов находятся «в минусе» и «могут ждать безубыточных цен, чтобы ликвидировать свои активы».

Нижней границей консолидации может выступить метрика Investor Cap Price на уровне $17 650.

Данные: Glassnode.

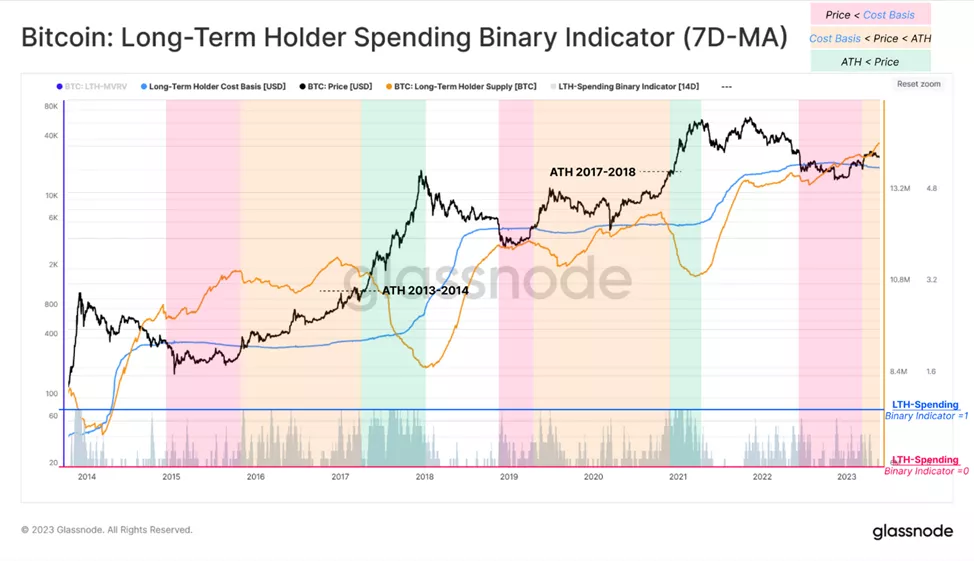

На фазу равновесия также указывает соотношение текущей цены и «себестоимости» применительно к долгосрочным инвесторам. Превышение второй метрики первой ознаменовало завершение «формирования дна».

Отслеживающий траты ходлеров индикатор Spending Binary Indicator (7D-MA) показал «чрезвычайно низкие значения в течение последних недель с активизацией во время недавней коррекции».

Данные: Glassnode.

Напомним, в марте опрошенные CNBC влиятельные фигуры индустрии продемонстрировали бычий настрой в отношении биткоина. По их прогнозам, в текущем году актив может протестировать прежний максимум и даже достигнуть $100 000.

В росте до этой отметки, но в течение 12 месяцев, выразил уверенность основатель и CEO аналитической компании Messari Райан Селкис.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Ontology

Ontology  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren